2 MINS READ

Perpetually Adaptive Enterprise

At TCS, we don’t just help businesses transform. We help them become perpetually adaptive enterprises, built to evolve continuously and confidently in a world of constant change.

- Banking

- Capital Markets

- Consumer Packaged Goods and Distribution

- Communications, Media, and Information Services

- Education

- Energy, Resources, and Utilities

- Healthcare

- High Tech

- Insurance

- Life Sciences

- Manufacturing

- Public Services

- Retail

- Travel and Logistics

- Artificial Intelligence and Data & Analytics

- Cloud

- Cognitive Business Operations

- Consulting

- Cybersecurity

- Enterprise Solutions

- Industrial Autonomy & Engineering

- Network Solutions and Services

- Sustainability Services

- TCS Interactive

About Us

We deliver excellence and create value for customers and communities - everyday. With the best talent and the latest technology we help customers turn complexity into opportunities and create meaningful change.

TCS Insights

Point of views, research, studies - on the latest themes - to help you expand your knowledge and be future ready.

Recent recognitions

View allWant to be a global change-maker? Join our team.

At TCS, we believe exceptional work begins with hiring, celebrating and nurturing the best people — from all walks of life.

Top Results

You have these already downloaded

We have sent you a copy of the report to your email again.

Discover TCS

Highlights

- Where they will compete: In a digital world, how they are deciding in which businesses and markets to play (business strategy)

- What to compete with: How they plan to digitize what they already sell to consumers, as well as new offerings (product/service strategy)

- How to compete: How they are digitizing the processes by which they create demand for, and supply of, their offerings (operational strategy)

- How to lead: the culture and talent management strategies they believe they need to compete in a far more digital world (talent management strategy)

Insights in this article

Over the past half-decade, digital technologies have profoundly changed how the global media and entertainment industry does business, and the COVID-19 pandemic has accelerated the trend. How Media & Entertainment organizations are planning to balance radical innovation with incremental optimization in the following arenas.

To understand the answers to these questions, Tata Consultancy Services surveyed 1,206 senior executives from Global 2000 companies with average revenue of $13.9 billion, including 26 companies with sales of $100 billion or more. In addition to the media and entertainment sector, TCS surveyed 16 other sectors. The survey was conducted in the first half of 2021 in four regions of the world: North America, UK and Europe, Asia-Pacific, and Latin America.

This report is based on surveys with 62 media and entertainment companies with average revenue of $8.2 billion. About two thirds are between $1 billion and $5 billion, and the remainder are more than $5 billion. A slight majority (56%) are based in North America, and 31% are in the UK and Europe. Another 10% are in Asia-Pacific, and 3% are in Latin America.

Our survey participants were roughly evenly distributed among four subsectors: print and online publishers of traditional media (newspapers, magazines, books; 15 respondents), broadcasters (17), internet publishers (15), motion pictures/streaming video (11), and business and consumer data suppliers (4). The study also compares how two groups of respondents answered our questions: “Leaders” and “Followers.” Leaders were those media & entertainment companies that had higher-than-average increases in both revenue and profit between 2015 and 2019.

Essential Takeaways

- Two-thirds of the media and entertainment companies surveyed think their toughest competitor will from outside their traditional industry, YET half of those same companies (and a little over half of all media firms) are still planning as if the only competitors to think about are the established players.

- Most successful media and entertainment companies have already made the switch from analog to digital and are accelerating the move from sales to renewals. The executives from the Leader firms in this industry reported that two-thirds of their revenue comes from digital products or services (compared to less than a third for Followers) and they expect subscriptions to represent over two-fifths of revenue by 2025 (also compared to less than a third for Followers).

- While every industry is focused on leveraging the ability to personalize its sales and marketing through precise recommendation engines and retargeting through advertising networks across content platforms, media and entertainment companies generally are that platform — even as they are deploying that capability for their own sales and subscriptions. But successful media firms are even more focused on building nimbler supply and production chains with more options to choose from. Thus, if algorithms can make recommendations to improve demand, they could also suggest additional options to improve supply.

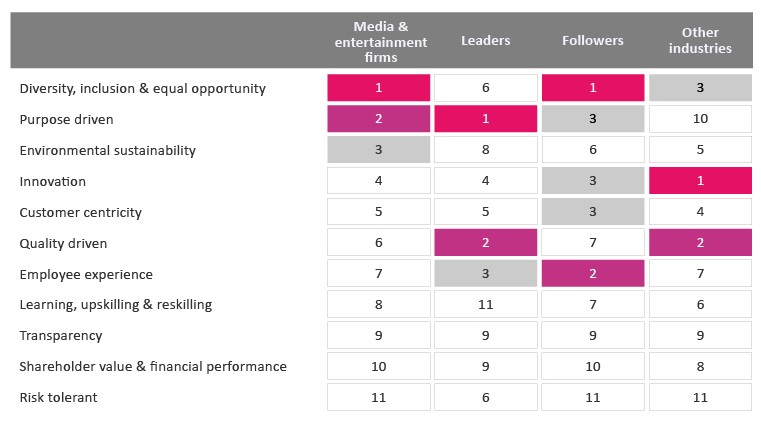

Media & entertainment firms also weighed in on what they believe will be their company’s most important cultural values.

Belief in action

The Backbone of Remote Working – Distributed Agile Teams

Customer service and continuous improvement processes benefits | TCS

CMO Study Highlights: The Initial Findings Report

European Leaders Focus on Innovation & Customers