Highlights

- Financial institutions must ensure accurate data validation and reconciliation to avoid regulatory penalties, operational inefficiencies, and reputational damage.

- Traditional systems struggle with challenges like data inconsistency, high volume, and complex formats, often requiring heavy IT involvement.

- GenAI enables business users to manage validation rules in natural language, improving speed, accuracy, and reducing reliance on technical teams.

- This AI-driven approach is also applicable across industries like credit bureaus, healthcare, and retail banking, enhancing data governance and operational efficiency.

In this article

Data Quality Matters

Inaccurate data can cost financial institutions millions – and impact their reputation.

Data validation and reconciliation are critical processes in financial institutions to ensure accuracy, completeness, and consistency of data, especially in the context of post-trade and open positions reporting to regulatory bodies and trade repositories such as the SEC, ESMA, DTCC, HKMA, etc. Financial analysts rely heavily on accurate data to perform risk assessments, ensure compliance, and make informed decisions.

Erroneous data can have a monumental impact on financial institutions, manifesting in various forms:

- Regulatory penalties: Financial regulators impose hefty fines for inaccurate or incomplete data submissions. For example, under regulations such as EMIR or SFTR, non-compliance can lead to significant financial repercussions. It has been observed that delayed settlements, pricing errors and compliance breaches can lead to fines in multi-million dollars.

- Operational inefficiencies: Incorrect data leads to trade rejections, manual investigations, and re-submissions, consuming valuable resources and time. On average, a financial analyst may spend up to a third of their time in validation iterations, with transaction data needing to be validated and/or reconciled multiple times before submission to regulatory bodies.

- Reputational damage: Persistent data quality issues can tarnish an institution's reputation, eroding stakeholder trust. Inaccurate reporting can lead to a loss of credibility with clients, investors, and regulators.

- Inaccurate risk assessments: Poor data quality compromises the accuracy of risk assessments, potentially exposing the institution to unforeseen financial risks. This can affect the institution's ability to manage risk effectively and make informed strategic decisions.

- Impact on business productivity and efficiency: Bad data hampers business productivity by increasing the workload for employees who must manually correct errors and reconcile discrepancies. This diverts resources away from more value-added activities and can lead to employee burnout and decreased morale.

Data Validation Maze

Validating trade data from diverse sources is a race against time and complexity.

Financial institutions often receive data from various sources, including trading platforms, counterparties, brokers, and internal systems. This incoming data must be validated to ensure accuracy before submission to regulatory bodies. Challenges include:

- Data consistency: Ensuring that data from different sources is consistent and matches up correctly. Discrepancies can lead to errors and non-compliance.

- Timeliness: Data must be processed and validated within strict timeframes to comply with reporting deadlines.

- Complexity: Different data sources might use varying formats and standards, complicating the validation process.

- Volume: The sheer volume of incoming data can overwhelm traditional validation systems, leading to bottlenecks and delays.

The transaction data accuracy requirements by regulatory bodies and trade repositories are very stringent and require various data validation checks, including:

- Reporting templates: Each trade repository has specific reporting templates that must be adhered to, ensuring data is formatted correctly.

- Mandatory fields: Certain fields are mandatory for each submission, such as trade ID, counterparty information, trade date, and settlement date.

- Logic checks: Data must pass various logic checks to ensure consistency and accuracy. For example, the trade date must be before the settlement date, and the counterparty information must match regulatory records.

- Regulatory technology (RegTech): These platforms are integrated solutions designed to help financial institutions comply with regulatory requirements more efficiently. They offer capabilities such as transaction data reconciliation, risk management, compliance monitoring, and reporting automation.

However, these solutions have traditionally provided limited capabilities for business users, primarily due to their reliance on technical expertise for rule management and data reconciliation. Business users largely depend on IT teams to manage and implement validation rules using core technologies like SQL and DMN, etc. This dependency can lead to delays and inefficiencies, as IT teams must handle the technical aspects of rule management and their execution.

GenAI Empowers Finance

GenAI is transforming data validation - putting control in business users’ hands.

GenAI innovations are revolutionizing the landscape by offering more powerful data reconciliation and rule management capabilities directly to the business. With GenAI, businesses can define, simulate, and document rules in natural language, significantly reducing dependency on their technology organization. IT teams are then only required to manage the backstage by overseeing the core ruleset technology, ensuring it remains robust and up to date.

Integration with workflow solutions for maker-checker verification enhances the accuracy of validation. This approach ensures a dual verification system where one user (the maker) creates and inputs the data, and another user (the checker) verifies and approves it, ensuring exceptions are accurately validated.

GenAI can also assist in auto-suggesting and auto-correcting errors based on historical validation data. By leveraging machine learning algorithms, GenAI can identify patterns and common errors, providing real-time suggestions and corrections to users. This not only improves the accuracy of data validation but also significantly reduces the time and effort required by financial analysts.

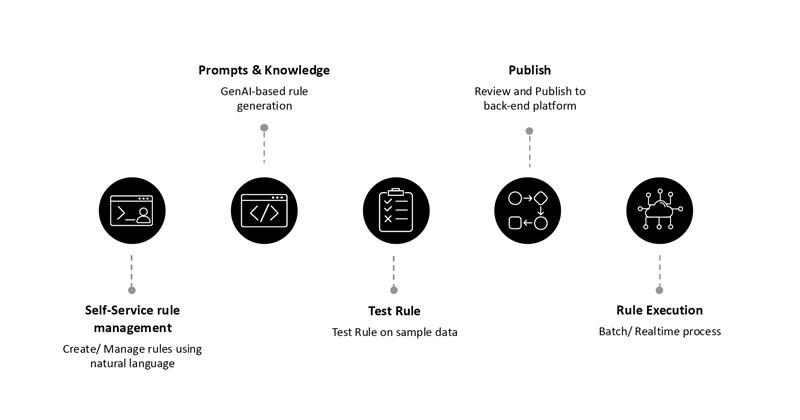

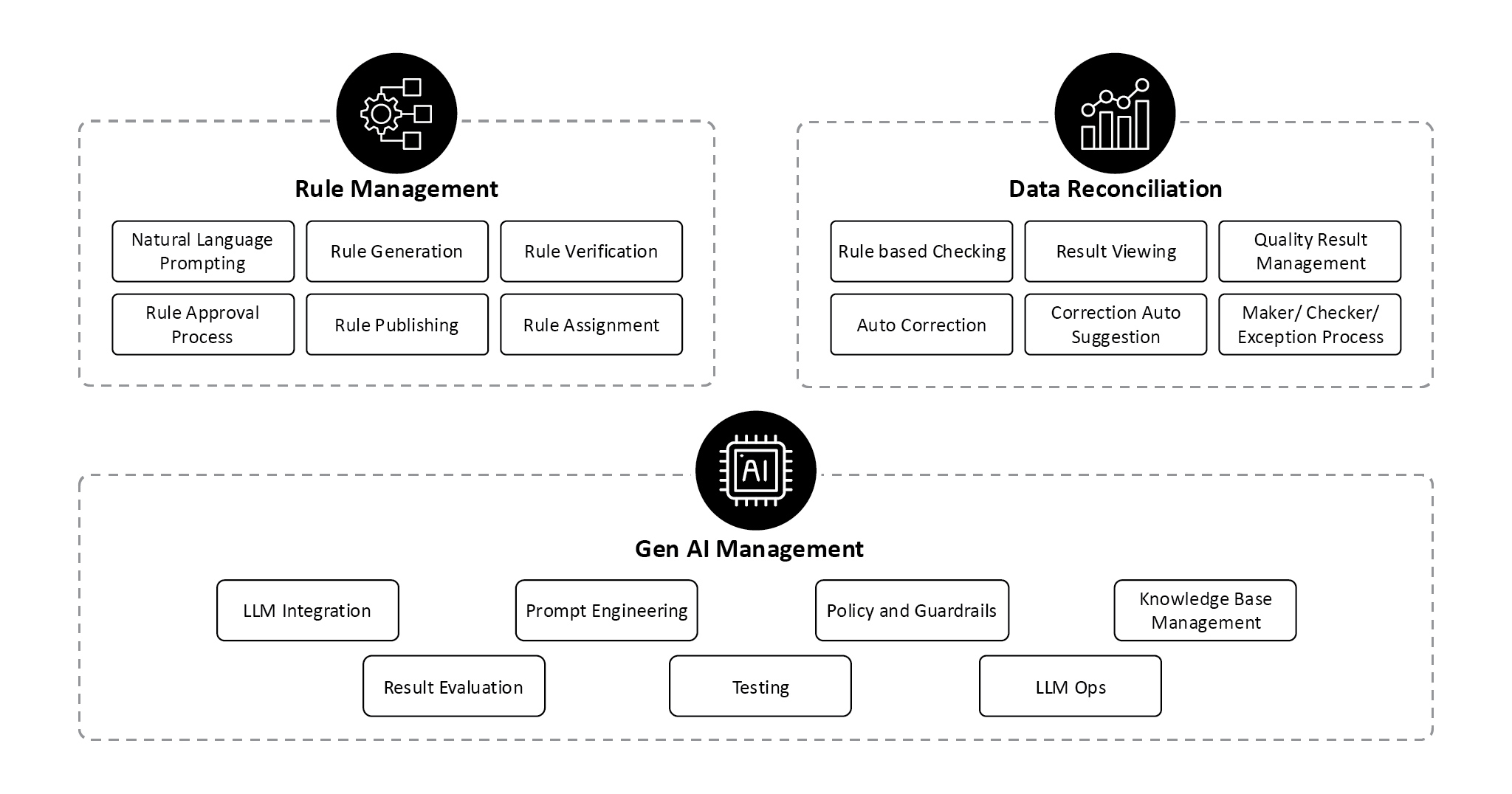

The basic functional building blocks to implement this kind of solution can be depicted as below:

- Rule management: Rules will be defined by business users using natural language. The component is responsible for managing an end-to-end lifecycle of rules. Based on requirement the rules can be configured and orchestrated for the quality checking pipeline. The rules will follow a workflow and published upon approval.

- Data Reconciliation: For managing application of rules either in batch or real time manner. The pipeline will be orchestrated for quality checking. The result of the quality checking can be verified post the validation. An auto correction suggestion and automatic correction feature will assist in automatic resolution of identified errors in the data set.

- GenAI management: The Gen AI module will be responsible for rule creation based on domain knowledge, rule syntax and available function libraries. The assistive rule generation process will help business users to describe rules that can be configured in appropriate formats, such as DMN, SQL, etc.

GenAI Beyond Finance

GenAI is reshaping data governance across industries—from credit to healthcare.

Data reconciliation and governance being critical to the success and compliance of financial services institutions, leveraging GenAI can bring speed and accuracy to data validation processes, reducing penalty implications and elevating brand reputation. With faster and more precise validation, institutions can avoid costly regulatory fines and enhance their credibility in the market. By enhancing the productivity and efficiency of business users, Gen-AI helps institutions manage data more effectively and make more informed decisions.

This approach can be extended to other industry domains such as credit bureaus, healthcare, consumer goods, and retail banking in payment apps and gateways.

In these sectors, accurate data validation and reconciliation are equally important, and GenAI can provide similar benefits, including reduced dependency on IT teams, improved compliance, and enhanced operational efficiency.

For instance, in the credit bureau industry, data reconciliation involves matching credit data from different lenders to ensure accurate credit scores. In healthcare, data validation ensures the accuracy of patient records and billing information, preventing errors in treatment and insurance claims. In consumer goods, accurate data reconciliation is crucial for inventory management and supply chain operations. In retail banking, payment apps and gateways rely on accurate data validation to reconcile transactions and prevent fraud.

By adopting GenAI, these industries can improve their data governance frameworks, enhance operational efficiency, and reduce the risk of errors and non-compliance. Ultimately, this leads to better decision-making, improved customer satisfaction, and a stronger competitive edge.