What we do

Highlights

- Biodiversity is evolving from a compliance requirement to a strategic growth lever, opening new revenue streams through biodiversity credits, green financing, and sustainable products.

- It mitigates supply chain, regulatory, and reputational risks while strengthening long-term resource security and overall business resilience.

- By leveraging nature-tech and digital tools, organizations can convert natural capital into measurable business value, fostering innovation, and differentiation in competitive markets.

- Aligning with global frameworks such as TNFD, SBTi, and EU BNG, enables businesses to attract green capital and meet the growing consumer demand for nature-positive brands.

On this page

Why biodiversity matters for businesses

Biodiversity underpins the resilience of ecosystems, which in turn supports food production, water regulation, and climate stability. For businesses, this is not an abstract environmental concern—it directly impacts supply chains, risk exposure, and market competitiveness. 70% of industries, especially agriculture, fisheries, forestry, and pharmaceuticals rely on natural diversity to secure raw materials and sustain innovation.

From Davos to UN-led initiatives, investors, and regulators are demanding stronger biodiversity accountability. Businesses that act early will gain market trust and long-term competitiveness.

The World Economic Forum reports that over 50% of global GDP is moderately or highly dependent on nature. Ignoring biodiversity loss exposes firms to systemic risks ranging from raw material shortages to reputational damage.

On the other hand, proactive engagement with biodiversity opens opportunities for product differentiation, ESG compliance, and financial incentives. Businesses that align with frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) and EU Biodiversity Net Gain (BNG) will not only mitigate risks but also establish themselves as leaders in the sustainability economy. Because this is not just about compliance for businesses but about staying competitive and building resilience in an economy where USD 44 trillion of global GDP is moderately or highly dependent on nature.

Nature risk is now financial risk; global policy frameworks are rapidly turning biodiversity from a voluntary initiative into a compliance requirement.

Policy enforcement over regulatory compliance

The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates biodiversity disclosures. Similarly, governments are integrating natural capital accounting into national regulations, compelling companies to track their dependencies and impacts on nature.

Financial institutions are also factoring biodiversity risk into lending and investment decisions. This means that businesses must measure not only their carbon footprint but also their biodiversity footprint.

But is only compliance enough? Policy incentives such as biodiversity credits, habitat banking, and blended finance can create opportunities for businesses that adopt biodiversity-positive practices. Early adopters who integrate biodiversity into governance frameworks can access preferential financing, subsidies, and market advantages. For example, agribusinesses adopting regenerative practices gain both compliance benefits and new income streams through credit registries.

Thus, policy is not merely a constraint; it is becoming a driver of innovation and differentiation. Because these policies surface the real exposure in supply chains, operations, and balance sheets.

Biodiversity loss is a business problem after all

When we look beyond business benefits, the critical question becomes: does biodiversity loss pose a risk to businesses? The answer is undeniable—it drives financial strain, disrupts supply chains, increases insurance premiums, rises compliance costs, and heightens operational vulnerabilities across various industries.

In agriculture, declining pollinator populations threaten yields of fruits, vegetables, and oilseeds. In manufacturing, water scarcity linked to ecosystem degradation disrupts operations. Fisheries face declining stocks, threatening food security, and employment.

Biodiversity loss also reduces resilience to climate shocks, making companies more vulnerable to droughts, floods, and even pandemics. Firms that fail to act risk stranded assets, loss of investor confidence, and diminished market share. Furthermore, they face reputational risks as consumers increasingly prefer nature-positive products.

Recognizing biodiversity as a material financial risk is the first step toward building business resilience in the face of ecological instability.

Monetizing biodiversity: Credits and natural capital

The shift from compliance to opportunity is most evident in how biodiversity is being monetized. Companies can now earn biodiversity credits by restoring habitats, enhancing soil health, or protecting endangered species. These credits can be traded to offset biodiversity impacts or treated as investment-grade assets.

How should these assets and ecological dependencies be accounted for? This is where natural capital accounting comes in—enabling organizations to quantify their reliance on natural systems and integrate these factors into financial reporting. For instance, agroforestry projects not only capture carbon but also boost biodiversity, generating dual credits. Financial institutions are recognizing these assets and offering preferential loans to biodiversity-positive businesses. The rise of biodiversity credit registries mirrors the earlier evolution of carbon markets, creating structured opportunities for businesses to align environmental stewardship with profitability.

In essence, biodiversity is no longer just a moral imperative; it is an emerging asset class with real market value. To measure, verify, and transact these benefits at scale, digital instrumentation is essential.

From reactive compliance to proactive strategy: The role of digital enablers

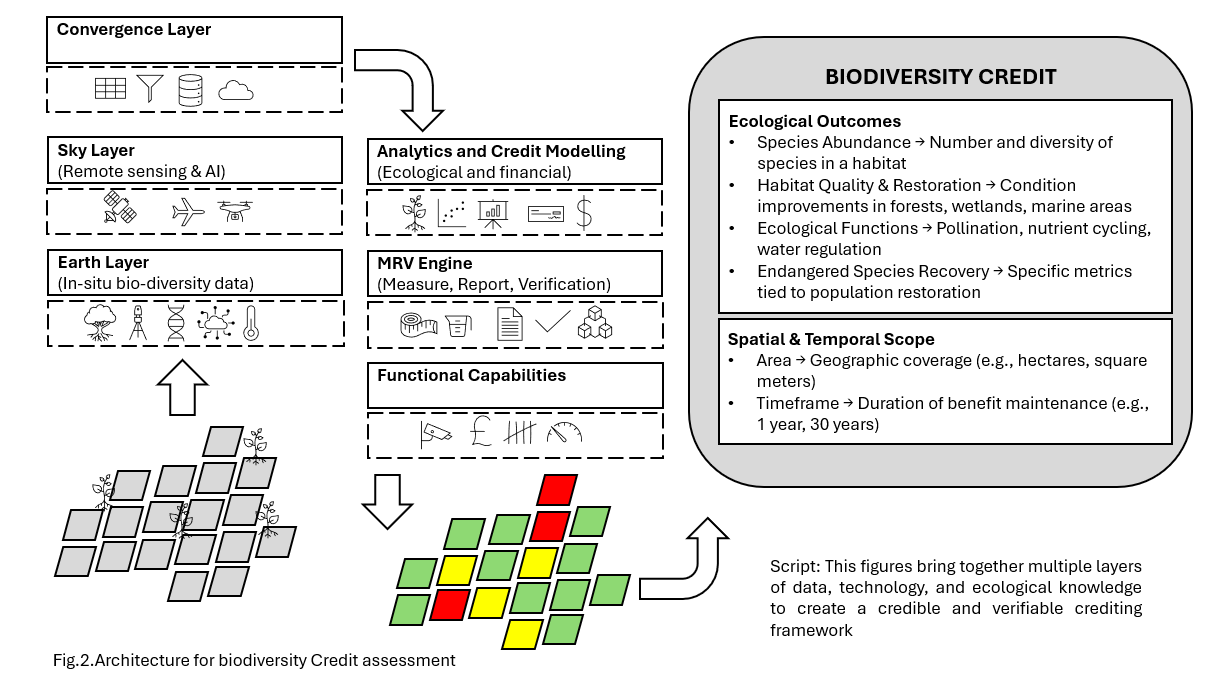

Technology plays a pivotal role in integrating biodiversity into business models. Satellite imagery and remote sensing allow monitoring of land use, deforestation, and habitat quality at scale. AI-driven analytics integrate diverse datasets from soil health to species richness into actionable insights. Blockchain platforms ensure transparency in biodiversity credit trading, while digital twins simulate ecosystem impacts under different business scenarios. Moreover, digital agriculture platforms now integrate biodiversity dashboards, enabling farmers to monitor biodiversity alongside productivity. These tools democratize access to biodiversity intelligence, making it easier for companies of all sizes to measure, report, and act. By leveraging digital enablers, businesses move from reactive compliance to proactive strategy, turning biodiversity into a competitive advantage.

Digital Twins and AI for Biodiversity Credit Accounting

The TCS Digital Food Initiatives (DFI),Digital Platform for NexGen Agriculture (DNA) platform integrates artificial intelligence, geospatial intelligence, and ecological datasets to create digital twins of ecosystems. AI serves as the core enabler, assessing ecosystem services and calculating verifiable biodiversity credits with credibility and scalability. By aligning with the Montreal Global Biodiversity Framework (GBF) and supporting emerging voluntary markets, the platform ensures transparency and trust. It empowers landowners, corporates, and policymakers to balance productivity with ecological stewardship. Ultimately, this AI-driven approach transforms ecosystems into measurable assets, paving the way for a next-generation biodiversity economy that rewards conservation and sustainability.

With data and tools in place, companies can move from pilots to a phased, KPI driven program.

A roadmap to make biodiversity a strategic growth lever

The phased approach towards biodiversity-positive business growth can be:

- Companies must assess their dependencies and impacts using recognized frameworks.

- They must embed biodiversity into governance by linking board-level oversight with operational KPIs.

- Businesses should invest in biodiversity-positive practices such as regenerative agriculture, sustainable forest management, sustainable ocean, sustainable sourcing, and ecosystem restoration.

- Businesses must leverage financial tools like biodiversity credits, blended finance, and impact investing to unlock new revenue streams.

- Companies should embrace transparency by publishing biodiversity disclosures and engaging with stakeholders.

This roadmap transforms biodiversity from a compliance checklist into a growth lever. Businesses that act early will secure regulatory compliance, investor confidence, and customer loyalty positioning themselves as leaders in the emerging nature-positive economy.

At the core of TCS Digital Food Initiatives’ DNA platform is artificial intelligence, enabling transparent assessment of ecosystem services and precise calculation of biodiversity credits. By supporting voluntary credit markets and empowering landowners, corporates, and policymakers, the platform paves the way for a next-generation biodiversity economy that balances productivity with ecological stewardship – putting AI at the heart of credible and scalable biodiversity crediting.

By adopting biodiversity-positive practices, businesses safeguard their future, strengthen resilience, and unlock new value creation streams–proving that economic growth and ecological balance can, and must, go hand in hand.