What we do

Highlights

- The future of payments will shift from present-day money movement to a broader concept of value exchange, aided by the increasing adoption of newer digital technologies and a favourable regulatory environment looking to bring innovative use-cases to the market.

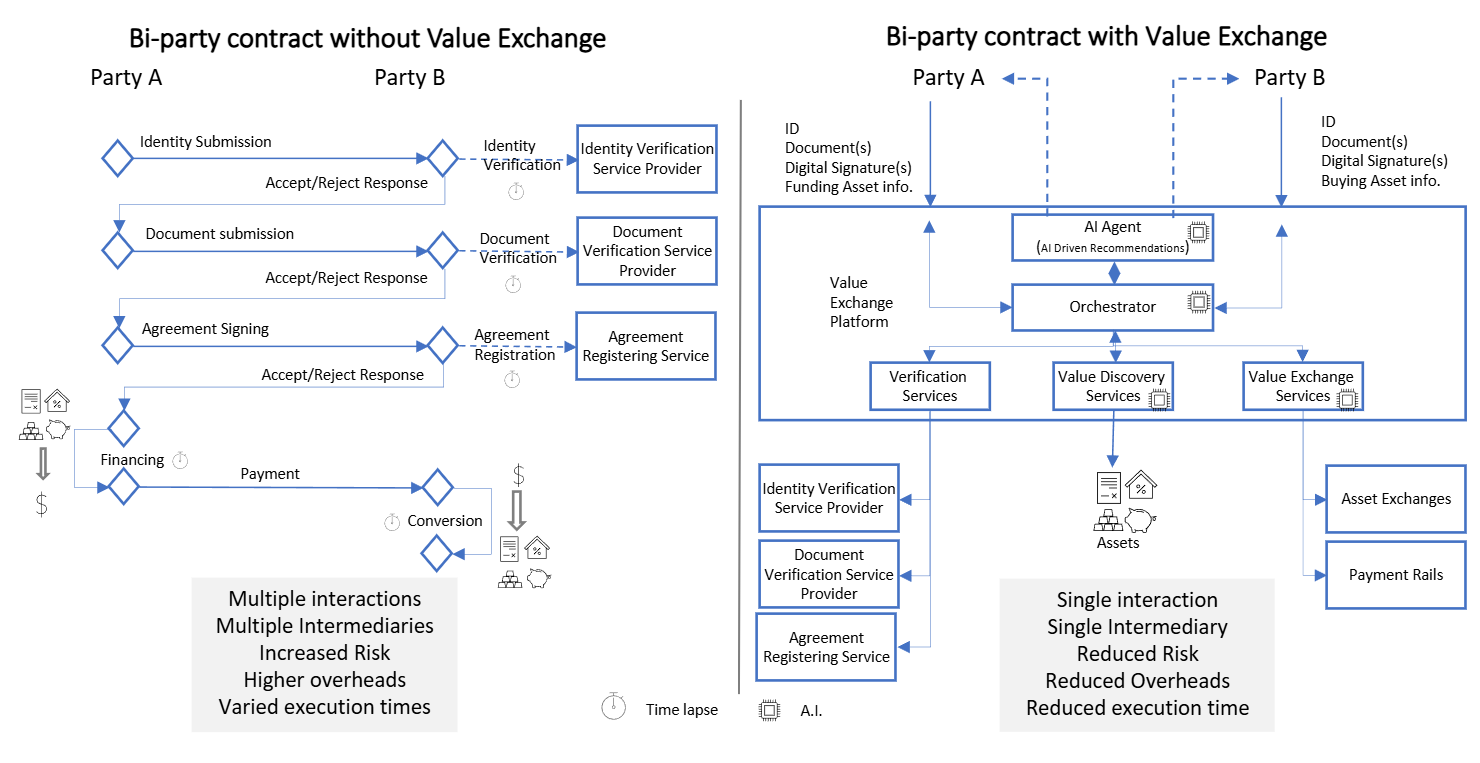

- Building on the lessons learned from embedded finance, value exchange will transform the way commerce is conducted. It will allow businesses and people to trade in efficient, seamless, transparent, cost-effective and secure ways without having to interact with multiple intermediaries or perform multiple actions over an uncertain time period.

- Businesses and Financial Institutions should start looking at value exchange as an overarching bridge that covers existing payment systems and asset exchanges, which tend to work separately.

On this page

Redefining payments: Role of digital assets

Commerce has historically evolved from reciprocal barter agreements to present day exchange of sovereign currencies. A transaction therefore involves a product or service with a value shown by its price, and the money used to pay for it, changing its ownership.

We are now seeing new technologies digitizing sovereign currencies (Central Bank Digital Currencies) along with issuance and use of private currencies of various forms that are priced basis sovereign currencies and other physical assets directly (stablecoins) or indirectly. The future of trade is hence rapidly evolving beyond using traditional money. Driven by increasing adoption of digitization of assets, tokenization, and embedded finance, value is now represented not just by currency, but also by digital tokenized assets like bank deposits, bonds, gold, property, commodities (grains, crops, etc), other assets like music art, photos, etc. and eMoney (bank account, overdraft account, credit card account, loyalty points etc). The digitized tokens of assets like property, art, etc, can also show the ownerships (viz. full or fractional). In essence, the technology is making these assets as suitable options for representing the value side of the trade. The future of payments will therefore shift from moving money to exchanging value between parties efficiently and securely.

What will drive the shift to value exchange?

The current payment mechanisms and methods have several limitations – dependency on infrastructure, varied rates of technology adoptions, cost and operational inefficiencies, lack of interoperability, and limited data visibility. As more people and businesses adopt new technologies and digital commerce becomes mainstream, these limitations are becoming more evident in the form of increasing fraud, customer dissatisfaction, overheads, and increasing costs of doing business. Embedded payments and finance have shown some success in reducing friction and addressing operational inefficiencies. However, this is only a small step forward.

With governments investing in digital public infrastructure (DPI) and regulators working closely with the industry on new use-cases, there is now a great opportunity to change how money is exchanged. This new focus on value exchange aims to encompass a broader range of value stores beyond conventional currency. This includes digital currencies, cryptocurrencies, stablecoins, and tokens, all representing various forms of digital value store and its transfer. Furthermore, the value exchange will evolve to include the creation and transfer of value derived from customer activity and data ownership, with access to data becoming a key driver of value.

What is value exchange?

The conventional way of doing commercial transactions requires both parties involved in a trade to agree on a price in a mutually acceptable form – such as a buyer purchasing goods from a seller for a specified amount of Dollars or Euros. If the buyer and supplier use different currencies, foreign exchange conversions are used to facilitate the transfer, converting buyer’s money into the supplier’s preferred currency. This is known as money movement.

Value exchange, however, takes this concept further by offering alternatives beyond conventional money. It enables an exchange of digitized assets instead of or in addition to, exchange of money. For example, rather than liquidating a bank deposit to buy a car from a seller, a buyer could merely transfer ownership of a tokenized deposit, passing along any associated claims such as future interest payouts to the seller as part of the transaction.

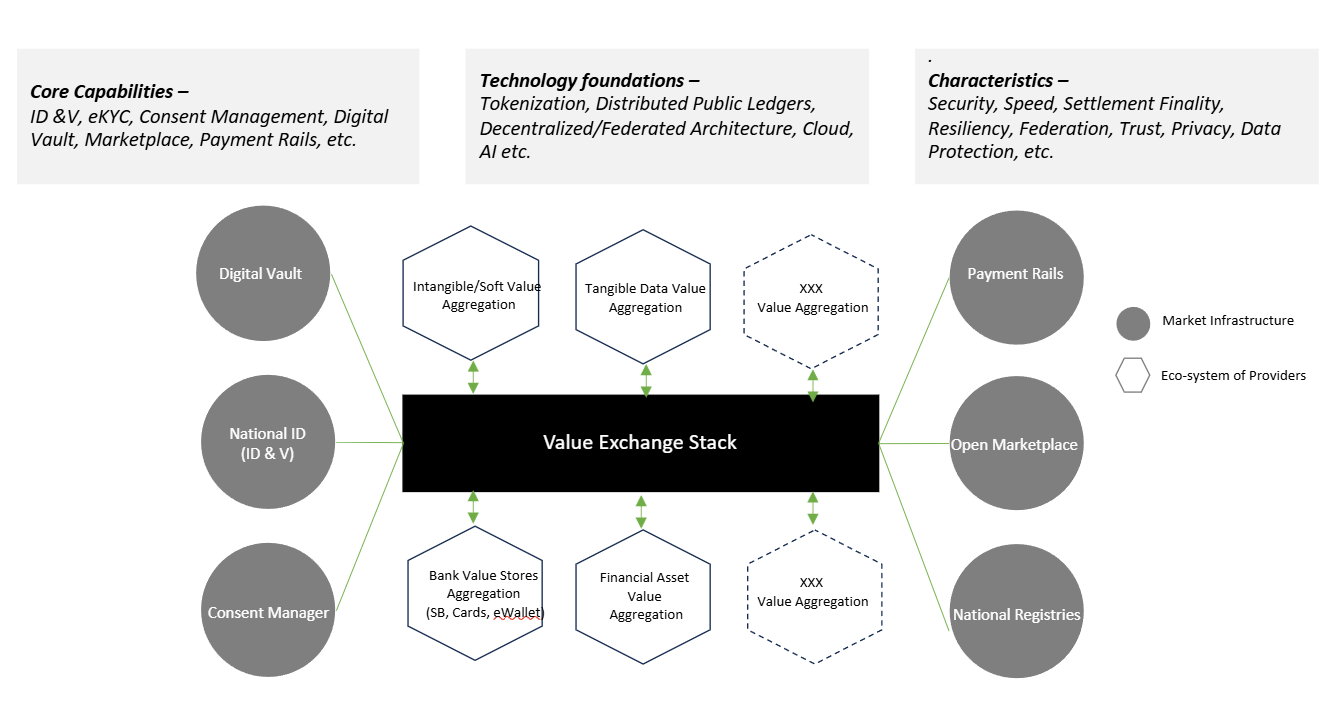

The shift from money movement to exchange of value requires an intelligent orchestrating capability, which we call the ‘Value Exchange Stack’ (VEStack). This comprises of the necessary systems, processes, and platform to handle different types of value including both monetary and non-monetary assets, digital native and non-digital assets. It works seamlessly with various public and private digital infrastructures, payment rails and exchanges within a well-defined regulatory framework. The steps in this value exchange involve identifying and authenticating parties, identifying tradeable assets/value stores, establishing ownership, discovering value (pricing), applying charging rules, complying with regulations, getting consent, setting-up the transaction sequence, creating and enforcing a smart contract, executing the trade and finally settling the same (both the asset transfer and money transfer).

Implications of Artificial Intelligence driven Value Exchange Platforms

The value exchange platform puts the ease of doing commerce at the center of this transformation. While discovering and negotiating a trade remain mostly unaffected, preparing and executing trades are envisaged to become more efficient by reducing overheads and cutting out unnecessary intermediaries involved in the trade. By using agentic AI and digitization technologies like tokenization and quantum cryptography, many decisions about options, cost benefits, risks, and security can be incorporated into every step of the trade. The value exchange can also incorporate AI based personalized recommendations about the best combination of digital assets to affect a seamless trade. This is illustrated with a simple example below.

Some illustrative use-cases are:

- Funding large value transactions like buying properties, corporate buyouts by using a mix of tokenized assets like deposits, equity, bonds, gold, and foreign currency alongside conventional money.

- Automated distribution of recurring cashflows among fractional owners of an asset, like rental income from real estate assets or royalties from intangible assets.

- Single step tender application processes where companies can efficiently and cost-effectively file applications, prove their credentials, and offer tokenized assets as collaterals.

- Allowing citizens to control their personal data and earn incentives from companies willing to pay for participation in targeted surveys.

- Governments can transfer benefits more efficiently through autonomous identity verification and real-time delivery of services or products, instead of just cash transfer.

- Making cross-border trade easier by automating and simplifying the process for multiple participants working as suppliers, vendors etc. on either side of the primary entities involved in the trade.

- Simplifying the setup of partnership and joint trusts with clearly established ownership records and conditional transfers that verify eligibility, credentials and periodic inward and outwards payments.

Global developments leading to the path of value exchange

Many countries are investing in setting up DPIs which include CBDCs, digital identities, real-time payment rails, registries and citizen wallets. Some countries, like the US is moving towards adoption of stable coins via “The Genius Act”. India is exploring tokenization of land assets1. Texas state in the USA has announced usage of Gold and Silver as legal tender2. We are also seeing increased adoption of stable coins like USDT from Tether, USDC from Circle3.

Private players are also significantly investing in collaboration with regulators. WeBank Technology Services has introduced value exchange infrastructure to boost HongKong’s Web3 ecosystem4. Furthermore, UK Finance has announced a new “Regulated Liability Network – RLN” for experimentation5. Bank of International Settlements (BIS) is exploring initiatives such as asset tokenization e.g. ‘Project Agora’ (A tokenised cross-border payment system), ‘Project Pine’ (which involves CBDCs and tokenized government securities to facilitate monetary policy)6 and ‘Project Promissa’ (a proof of concept for tokenizing promissory notes)7. Bank of England has come up with a design note on interoperability between different forms of money including digital money8.

Big banks are entering the realm of digital assets and smart contracts by developing their own eco-systems. For example, JPMD (tokenized deposit), Kinexys Digital Payments (formerly JPMCoin - stable currency), Kinexys digital assets (tokenized collateral and bond issuance) and JPMC Kinexys (formerly JPMC Onyx - a blockchain platform for financial services)9.

Preparing Financial Institutions for value exchange era

The rapid advancements in various digital technologies, combined with a supportive regulatory environment, offers significant opportunities for businesses, Financial Institutions, and technology service providers in developing robust, secure, and seamless value exchange systems.

Financial Institutions (FIs), as custodians and services providers, are ideally positioned to lead this transformation. While many FIs are experimenting with issuance of Tokenized Bonds and Deposits, the goal should be to encompass all asset classes, including liquid (money, equity), illiquid (ownership rights, claims, data), movable (jewellery, art, equipment) and immovable (land, properties) assets, among others. In addition to broadening the types of assets, FIs must also prioritize making these digital asset issuance and trading services open and interoperable, which involves building capabilities to issue digital assets on third-party networks and serve as custodians for tokenized assets issued by others for trading or collateral purposes.

Role of technology service providers

There is a need to look at ‘tokenization and token management’ as a critical capability area, as it covers not only payment cards, currency, and financial and non-financial assets but also factors like identities, programmability, and interoperability. Skills in technology related to Agentic AI, edge computing, cloud-native applications, Distributed Ledger Technology (DLT), smart contracts with conditionality, and intelligent routing capabilities across various exchanges and networks involving multiple standards and protocols will become valuable assets.

Collaborating with technology service providers experienced in navigating complex ecosystems, understanding various business domains, and working within multiple regulatory frameworks can greatly benefit Financial Institutions.

While traditional payment rails and exchanges function in isolation, FIs should consider the value exchange stack as an overarching bridge. This means that, in addition to developing new capabilities and skill sets, FIs need to evaluate their existing systems and related technical debt, assess their current operations and processes, and identify new integration touchpoints, aiming to become more adaptive, agile, and future-ready. This strategy should involve continuous adaptations, thereby evolving into a Perpetually Adaptive Enterprise.

Citations

- https://www.medianama.com/2025/04/223-tokenization-land-assets-nandan-nilekani/

- https://www.bizjournals.com/austin/news/2025/07/07/gold-silver-legal-tender-texas.html

- https://bitwage.com/en-us/blog/stablecoins-payroll-usdt-usdc-dai

- https://www.prnewswire.com/apac/news-releases/webank-technology-services-launches-value-exchange-infrastructure-to-boost-hong-kongs-web3-ecosystem-302421861.html

- https://ffnews.com/newsarticle/fintech/uk-finance-announces-new-regulated-liability-network-experimentation-phase/

- https://www.ledgerinsights.com/imf-event-central-bankers-give-rallying-cry-for-tokenization/

- https://www.ledgerinsights.com/bis-world-bank-snb-complete-tokenized-promissory-note-poc/

- Design Note – Interoperability models for UK based payments | Bank of England

- https://www.americanbanker.com/payments/news/how-jpmorgan-is-using-blockchain-to-make-b2b-payments-programmable