Services

Highlights

- Banking, financial services, and insurance (BFSI) firms must prepare for a new cyber reality with advancements in artificial intelligence (AI) today and quantum computing on the horizon.

- The best cyber defense is a good offense to effectively block and outmaneuver new and more sophisticated threats anticipated in an AI-driven, quantum-powered future.

- A future-proof cybersecurity strategy requires advanced AI detection response, predictive, and analytic capabilities along with the migration to post-quantum cryptography (PQC).

- Tomorrow’s BFSI industry leaders will be those who build their business on a secure technology foundation today and can perpetually adapt with cyber agility.

On this page

AI-quantum era

The evolution of AI and quantum computing has reached an inflection point, and BFSI leaders must balance the opportunities and risks.

An AI-driven, quantum-powered future holds big promise for transformative growth opportunities but also poses cyber risks of equal magnitude. Both traditional AI and generative AI (GenAI) technologies are already demonstrating their potential in the BFSI industry today. And practical business use cases for AI on a quantum computer are just a few years away.

Business opportunities enabled through rapidly evolving AI and quantum computing technologies may range from accelerating innovation and boosting efficiency and productivity to elevating the customer experience with hyper-personalized product and service delivery. At the same time, these technological advancements are giving rise to more sophisticated cyber threats and compounding the potential for risks. Downed systems, operational disruptions, and compromised data due to attacks can wreak havoc across an enterprise and its customer community and partner ecosystem. The erosion of trust can translate into major reputational damage and financial losses.

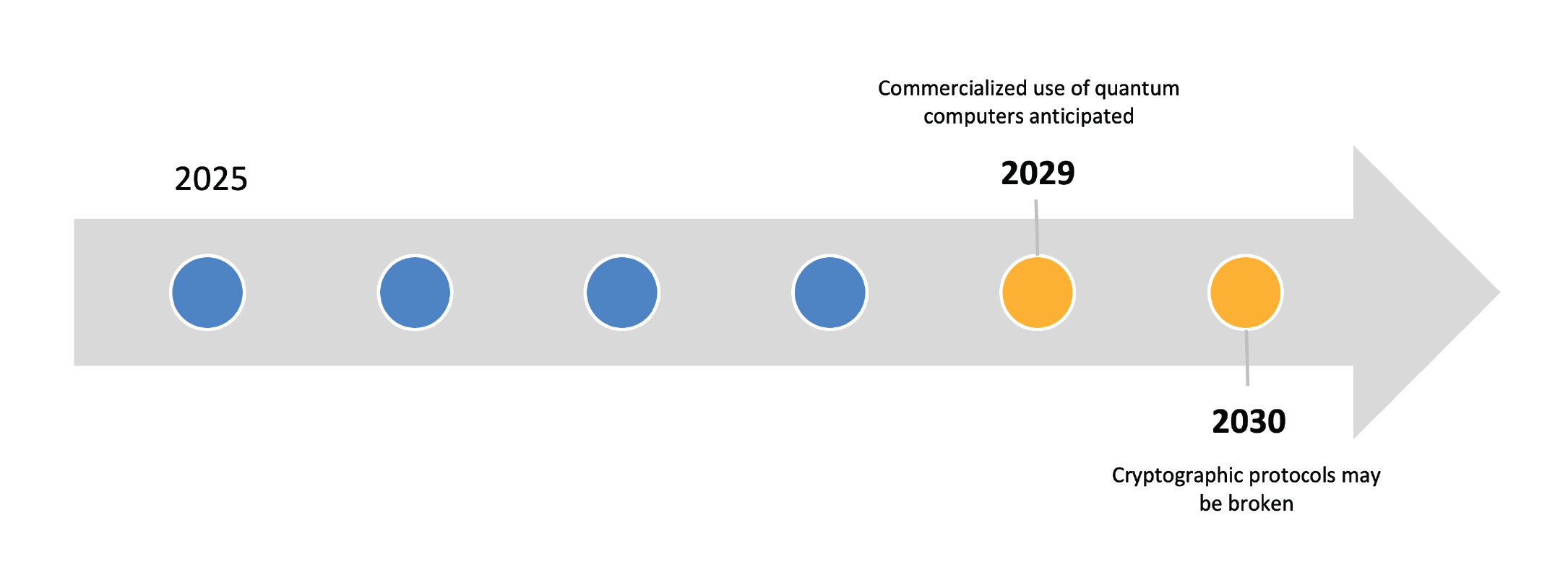

TCS expects that after 2028, we will start to see the commercialized use of quantum computers. And by around 2030 or possibly sooner, we expect quantum computers will advance enough to break current cryptographic protocols.

BFSI leaders are therefore challenged to transform their cybersecurity programs with AI and derisk adoption while also embarking on their migration to PQC standards. They must leverage the potential of AI and quantum computing advancements in a responsible way and ensure security and regulatory compliance with a comprehensive strategy.

De-risking AI adoption

With the wide-scale adoption of AI applications among BFSI firms, the need to address security, privacy, and ethical concerns has intensified.

Among the early adopters of AI, BFSI firms are well on their way to realizing the business benefits of automation efficiency and augmentation effectiveness. According to the TCS AI for Business Study – Banking, Financial Services & Insurance Report, the majority of BFSI execs surveyed (96%) have AI implementations that are planned, in process, or already completed.

At the same time, the industry is plagued by AI-assisted cyber threats, ranging from credential stuffing, account takeovers, and credit card fraud to phishing schemes and deep fakes. BFSI leaders are therefore also focused on how to best use AI and GenAI to predict and protect against growing threats, as even AI systems need to be secured.

Enabling a “succeed fast, fail fast” capability for rapid prototyping, testing, and fine-tuning to operationalize and put AI cyber solutions into production, chief information officers and chief information security officers can reduce the adoption cycle. By applying solutions based on a structured AI threat modeling framework, BFSI firms can identify specific threats and patterns and design appropriate controls. They can further apply AI-driven:

- Fraud detection systems to facilitate analysis of large volumes of transactional data in real-time, leading to the identification of suspicious activities with much greater accuracy and a reduction in false positives. This strategic use of AI and machine learning (ML) not only addresses existing inefficiencies but also helps drive innovation and growth.

- Managed detection and response platforms to identify zero-day attacks and insider threats that traditional security measures might overlook. This proactive approach significantly enhances overall security.

- Identity and access management solutions to manage user permissions and access controls, helping to ensure that only authorized individuals have access to sensitive information. Examples include customer onboarding and transactions of high-net-worth individuals based on know-your-customer procedures for identity verification. Additionally, automated network security tools can continuously monitor and defend against threats, delivering real-time insights and responses.

GenAI breaks the assumptions baked into today’s cybersecurity stack. Without rethinking core tooling, logging, and model-layer controls, enterprises face blind spots, data risks, and emerging AI-specific attack vectors. Leveraging advances in GenAI technology for cybersecurity, however, can significantly boost threat detection and response times. Enabling automated analysis and real-time summarization of actionable threat intelligence, GenAI offers the benefit of driving deterministic outcomes in addition to probabilistic outcomes.

To effectively secure new GenAI tools, BFSI firms will need to leverage an assurance and governance framework tailored to their specific use case needs. Implementing an agentic AI system is fundamental to establishing security policies and standards, clear expectations, and guardrails.

In effect, the role of GenAI agents with autonomous capabilities can serve to amplify cyber programs for better, faster threat detection and response. By using GenAI agents, BFSI firms can de-risk AI technology adoption based on the premise of AI for security, and security for AI.

A GenAI case in point

An AI-led cyber strategy for open banking can employ autonomous GenAI agents to protect against growing threats, essentially using AI to fight AI.

Application programming interfaces enable seamless data sharing between banks, fintech firms, and third-party providers, encouraging a collaborative environment that enhances customer experiences and drives innovation. Open banking allows customers to securely share their banking and financial data with authorized service providers, leading to the creation of personalized financial products and services.

While open banking offers expanded consumer options for a hyper-personalized experience and enhanced service delivery, it also introduces data security and privacy risks. Balancing such AI-driven industry innovations on a secure technology foundation with agentic AI capabilities is paramount to earning and maintaining customer trust for open banking products and services.

Migrating to PQC standards

As quantum technology matures, BFSI firms must embrace entirely new encryption and security protocols to future-proof systems and data.

Quantum computing will empower BFSI firms with advanced data processing and analytical capabilities for solving highly complex, multidimensional problems in a fraction of the time possible today. This emerging technology could yield, for instance, computational leaps in areas like strategic investments, risk assessment, and fraud prevention. But with these leaps, encryptions that are hard to break today with classical computers may be broken in minutes with tomorrow’s quantum computers.

Another more immediate concern facing BFSI firms which handle sensitive data is the impending threat of “harvest now, decrypt later” when quantum computers will become available. BFSI leaders must therefore focus on starting their PQC migration now, but the journey is not so straightforward.

Typically operating on a large and complex application landscape, BFSI firms also rely on third parties for security and are challenged with in-house bespoke and old legacy applications. For in-house applications, there may be some resistance from application owners and teams. Mainframe applications operating on older technology may also hinder the adoption of newer quantum safe algorithms.

A phased and carefully tailored migration approach to PQC will be required. Compensating controls must be identified and applied to mitigate risks in the near term while BFSI firms work toward a more permanent quantum-safe solution over the next few years.

The quantum journey begins with discovery and progresses from risk assessment and decision making through remediation and validation. Ensuring a successful journey requires a comprehensive assessment of an organization’s crypto inventory and development of a strategic roadmap for enabling crypto agility with automated application remediation capabilities.

While vendors are working to enable quantum-resistant solutions, BFSI organizations can start preparing by decoupling their prioritized applications for PQC migration. BFSI firms must effectively enable the ability to rapidly adapt and respond to continually evolving and increasingly sophisticated threats of much larger scale and impact.

Meanwhile, BFSI firms may also look to employ the use of other quantum technologies. For example, quantum ML holds promise for enhancing current technology capabilities from both business and cybersecurity use case perspectives. Leveraging current and historical data, quantum ML can significantly boost data analytics and predictive capabilities. As the technology advances, more accurate predictions will help BFSI firms make better informed and more strategic decisions while also driving more proactive actions.

Being cyber resilient

To be effective today and future-ready tomorrow, a cybersecurity strategy must be a forethought and not an afterthought.

Seizing business opportunities with cyber confidence and resilience in an AI-driven, quantum-powered world will depend on a strategic, top-down, and holistic approach. BFSI leaders must prioritize cybersecurity investment decisions based on the level of risk and potential return. They must also ensure essential governance and security capabilities are built into applications at the start.

Developing and implementing an effective cybersecurity strategy is essentially a game of “cat and mouse,” as adversaries are always looking to pounce on the vulnerable, unsecured areas of an enterprise. Enabling and supporting zero trust requires dynamic security policies and continuous monitoring. As we prepare to enter the next AI-quantum era, BFSI leaders must perpetually adapt and enhance their cyber defense and offense to keep up with technological advances and stay ahead of potential adversaries.