Industry

Highlights

- Half-hourly settlement (HHS) is accelerating the UK’s transition to net-zero by enabling suppliers to offer cheaper, greener energy using real-time smart meter data.

- By leveraging low-carbon sources, HHS enhances grid flexibility and empowers consumers to actively participate in the energy market through electric vehicles (EVs), solar panels, and home batteries.

- With energy usage settled every 30 minutes, HHS supports smarter tariffs, optimizes grid efficiency, and fosters innovation. This dynamic approach encourages more responsive energy consumption and helps build a more sustainable, resilient energy system.

On this page

Market context

The UK energy market has undergone significant changes with the rise of renewable energy and increased awareness of climate change, creating new opportunities for innovation. Despite this, the recent energy crisis has made energy a more expensive commodity and increased volatility in the wholesale market, raising the affordability risk. Innovations in flexible energy systems and the market-wide half-hourly settlement (MHHS) program present opportunities for energy suppliers to make affordable and sustainable choices without compromising the security of supply. Investment in renewables has increased, with £300 billion invested since 2010 and an additional £100 billion expected by 2030. According to the UK generates about—60% energy from low-carbon sources. While customers are becoming prosumers with the growth of EVs, solar, and batteries at the domestic level, more must be done to increase options and incentives for domestic customers to switch to better tariffs.

MHHS

The UK’s MHHS program intends to maximize the opportunities provided by smart metering to build a smarter, more flexible energy system.

What MHHS aims to achieve:

- Enable all the meters to be settled based on actual half-hourly data, a change enabled by the rollout of smart metering

- Improve data accuracy in energy settlement by replacing infrequent estimates with precise, time-stamped consumption data

- Expose suppliers to the true cost of electricity usage, encouraging them to develop innovative tariffs—like time-of-use pricing—and services that reward consumers for shifting their energy use to off-peak times

- Deliver significant consumer benefits, with Ofgem estimating net savings between £1.6 billion and £4.5 billion by 2045

Why it matters

Currently, energy suppliers buy electricity from the wholesale market, where prices fluctuate every 30 minutes. However, they lack the tools to reflect this variability at the individual customer level because settlement relies on broad consumption profiles. This outdated system limits their ability to send accurate price signals or incentivize smarter energy use. MHHS changes that. By mandating half-hourly settlement for all customers starting October 2025, the program enables a more dynamic and responsive energy market—one where consumers, suppliers, and the grid all benefit.

By 2026, all electricity consumers in Great Britain will be settled using actual half-hourly data—marking a major shift from the current system based on estimated consumption profiles.

Opportunities

MHHS will enable the introduction of time-of-use (TOU) tariffs that reflect real-time energy costs and incentivize customers to shift their consumption to off-peak periods when renewable energy is more abundant and affordable. This shift promotes fairer pricing, reduces peak demand and lowers reliance on fossil fuels. For suppliers, MHHS will also unlock new opportunities to innovate in pricing models and offer tariffs that are closely aligned with the actual cost of energy at different times and customer segments. Energy suppliers: Key beneficiaries of MHHS MHHS empowers energy suppliers to lead the net-zero transition by offering:

- Flexible tariff structures tailored to real-time consumption.

- Energy trading platforms that support prosumers—customers who both consume and generate energy.

- Demand response services that reward customers for adjusting usage during peak times.

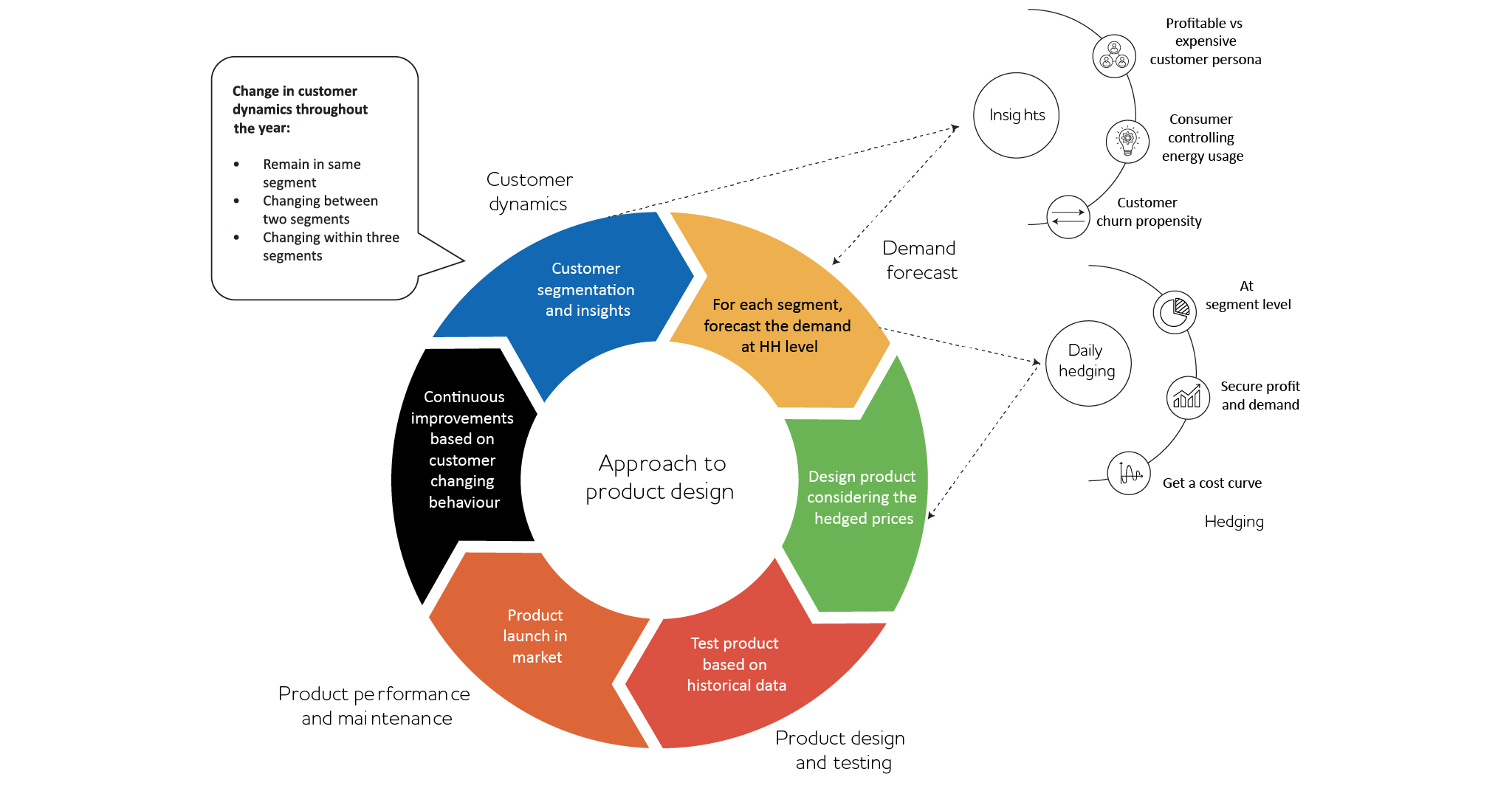

With access to half-hourly data, suppliers can move beyond generic segmentation. They can build persona-driven models that reflect seasonal shifts and evolving customer behavior, balancing cost-to-serve with profitability.

Smarter customer engagement and retention

By analyzing granular consumption data, suppliers can:

- Understand customer preferences and usage patterns.

- Offer dynamic tariffs that reward energy efficiency, sustainability, affordability, and loyalty.

- Improve retention strategies by delivering predictable bills and personalized value.

This data-driven approach helps suppliers align their offerings with what customers truly need—making energy more accessible and appealing.

Sharper decision making for long-term profitability

Half-hourly settlements give suppliers a clearer view of customer profitability. They can:

- Identify high-value customer segments.

- Optimize pricing strategies and cost management.

- Compare profitability across traditional profile classes vs. actual HH consumption.

By evaluating profitability through a “Cost to Serve” lens, suppliers can fine-tune services and tariffs, enhance operational efficiency, and build a more sustainable business model.

Investment areas

The MHHS program focuses on investment in infrastructural, data processing, and market readiness areas that help enable real-time energy settlement across the UK.

Data and insights: Leverage HH data to segment customers by usage patterns and demographic, behavioral, and lifestyle factors. Combining consumption data with broader customer insights (such as sustainability preferences or budget sensitivity) can create detailed customer personas that capture diverse needs. These personas can be used to build and input the demand forecast model for better hedging.

Utility domain-relevant configure, price, quote (CPQ) product: By leveraging a utility domain-relevant CPQ product, suppliers can create targeted offers for different customer personas, roll out advanced pricing strategies, and perform "what-if" analysis to test new product offerings. Additionally, they can model the impact of tariff changes or renewable energy introduction on different customer segments, enabling informed strategic decisions toward optimizing products and ensuring a profitable and sustainable business approach.

Data-driven integrated product strategies with a feedback loop: After a successful investment in data insights and a CPQ solution, a feedback loop on tariff market performance can be incorporated. HH data is continuously analyzed to refine customer personas and product offerings.

Conclusion

The move to half-hourly settlements presents unique opportunities for UK energy suppliers to understand customer behavior better, improve profitability tracking, and tailor products to individual needs.

However, new risk arises as non-traditional players may rapidly gain market share by delivering more agile, customer-focused solutions. To remain resilient and lead in this evolving landscape, traditional suppliers must invest in enhanced data capabilities, flexible product offerings, and strategic technology investments such as CPQ systems and advanced analytics. By doing so, they can drive personalized customer experiences, optimize costs, and ensure long-term success in a dynamic market.