Industry

HIGHLIGHTS

- Every product that is returned triggers a ripple effect—higher logistical costs, inventory inefficiencies, and an alarming increase in the carbon footprint.

- In a competitive retail landscape where profit margins are razor-thin, rethinking returns management is a strategic priority.

- Rather than adopting a one-size-for-all approach, retailers must consider a personalized returns strategy with artificial intelligence.

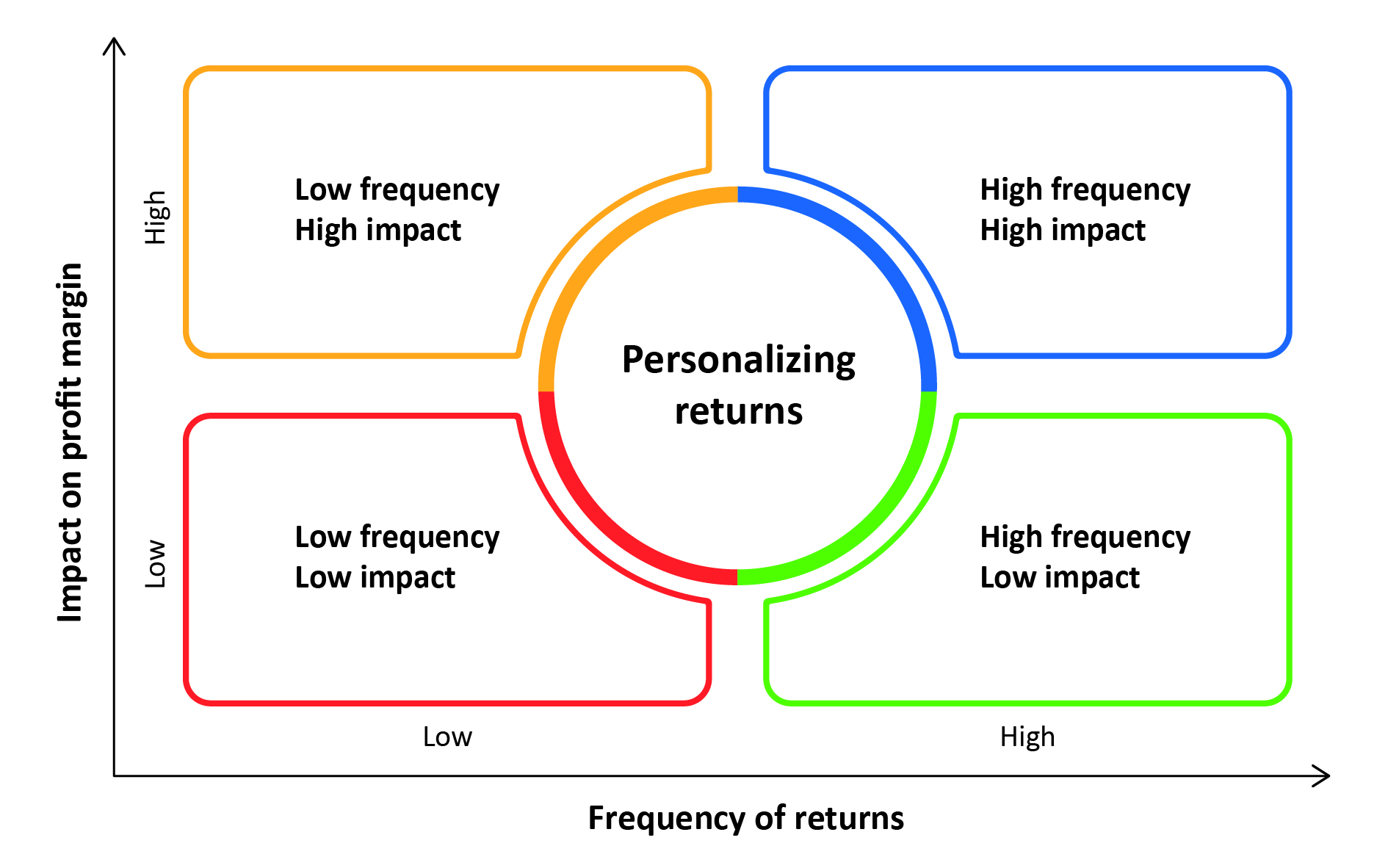

- The margin miles quadrant can help personalize the strategy based on the frequency of returns and the impact on profit margins.

On this page

The ripple effect

Even as retailers register record-breaking ecommerce sales year-on-year, beneath the surface, the story is a bit grim.

An estimated 24% of items (about one in four items), bought during peak seasons are likely to be returned. Every item that is returned triggers a ripple effect—higher logistical costs, inventory inefficiencies, and increased carbon footprint. As customer expectations for seamless returns collide with the reality of strained supply chains, the sustainability of online commerce hangs in the balance.

In a competitive retail landscape where profit margins are razor-thin, streamlining returns is no longer just a backend issue; it’s a strategic priority. It's time for retailers to rethink returns management. Rather than adopting a one-size-for-all approach, retailers must consider a personalized returns strategy. By tackling returns proactively, retailers can turn a costly pain point into a strategic advantage—protecting margins while unlocking richer customer experiences.

Margin miles: A new metric for redefining returns management

Traditionally, supply chains are designed to enhance the forward movement of a product to sell it at the earliest opportunity.

Most businesses accept returns as a necessary evil and avoid tackling the problem head on, primarily due to the complexities associated with it.

The distance the returned product travels has a direct impact on the logistics expenses and the number of touches, potentially degrading the value of the product while affecting profit margins. This highlights the importance of a new supply chain metric, ‘margin miles’. Retailers must prioritize margin miles as much as other key performance indicators (KPIs) to improve return processes and management. This has the potential to recover value, reduce environmental impact, and enhance customer loyalty. With the emergence of new shopping behaviors and return policies such as returnless refunds by competitors, retailers must develop the capabilities to significantly improve returns management, turning it into a competitive advantage rather than a liability.

Tackling serial oversights and serial returners with AI

A triage of reasons for returns exposes lapses from both sides—retailers and shoppers.

Retailers are accountable for serial oversights such as product damages during transit, and delayed or wrong deliveries. Other misses include insufficient product details and ineffective price or promotion management such as reducing the price every 24 hours.

A leading retailer was consistently facing the highest return rates for one of its product offerings, a 50-inch smart television. By analyzing returns data, we identified product damage while shipping, missing accessories, or installation issues as the most common reasons for returns. This pointed to oversights by the carrier partner. By leveraging machine learning models, we analyzed the return patterns and helped identify an alternative carrier partner, nipping the issue at source.

Similarly, for another leading retailer, we helped address frequently missing high-value products from customers’ porch or doorstep post delivery. By encouraging the retailer to revisit the delivery window for high-value items aligned with customers’ availability, we not only ensured rapid, but also perfect and safe delivery.

Shoppers who exploit retailers’ fulfillment and return policies are equally responsible for rising returns. In fact, serial returns pose more challenges than serial oversights because it is a behavioral issue. If shoppers are manipulative enough to habitually resort to bracketing (ordering different styles or sizes with the intention of returning excess items) or wardrobing (returning clothes after wearing them once), it’s likely that they can manipulate their identity as well. Retailers must look beyond account name or sign-in ID and consider a multitude of other factors such as payment cards and delivery zip code to identify serial returners. By establishing partnerships with payment gateway providers and fintech companies such as Klarna and Clearpay, they can gain significant insights into customers’ broader transaction behaviors.

Margin miles quadrant: Putting the smile in profit margins

By harnessing the power of AI, retailers can anticipate returns, conduct data-driven impact analysis on profit margins, and customize the shopping and return experiences.

Typically, shoppers in this segment are likely to be genuine; their return rate is less than 10%—one item returned out of every 10. Avoid penalizing them as these shoppers may be more vocal about their positive returns experience, thereby helping you acquire new customers.

Based on the reason for returns and product attributes (product value, fragile, off-seasonal product, end-of-life product), use AI to evaluate which would be a better—deciding on the optimal return journey or opt for returnless-refund. For example, if the customer has returned the product citing damage in transit and has added an image of the damaged product as proof, irrespective of product value, it is best to opt for return-less refund to avoid processing costs that is likely to impact profit margins further.

The return rate of shoppers in this segment is 40-50%, with 4-5 items returned out of 10; however, the impact on the profit margin is considerably low.

A holistic understanding is inevitable for this shopper segment. Leverage AI to understand different shopping and return patterns across various periods such as regular days vs promotional sales vs holiday seasons, as well as during new product launches and personal events such as birthdays. Typically, customers in this segment tend to buy various sizes of identical products during promotional sales and return most of them. Automatically flag such customers for excessive returns and then monitor their baskets during these events. If there are multiple sizes or colors of the same item, explicitly encourage them to validate their basket, and present appropriate choices based on past shopping and returns while gently cautioning about past return claims. This strategy will help retailers regulate impulsive shopping behaviors and make customers more aware of their purchase decisions and potential charges in case of returns.

Shoppers in this category return fewer items, yet the impact on profit margin is significant, primarily due to the product value and the cost of processing returns prior to being resold. Ensure that the returned items are collected and processed in an economical way and put back into sales as early as possible. For example, for wrong item delivery of a high-value electronic product, creating a replacement order with the right product would help to sell it at full price, preventing loss of revenue while improving positive customer experience.

Instead of creating a return journey that is likely to entail several weeks of processing as well as incur damages during transit impacting profits, it is prudent to divert these returns to nearby stores where they can be sold at full price within the season. By leveraging AI to understand the reasons for returns, finding opportunities to prevent a lost sale, and adopting a cost-effective way to process the return will help prevent the impact on profit margin.

Exercise caution when addressing this shopper segment, as many of these shoppers are likely to resort to wardrobing and tend to be the largest spenders.

A comprehensive evaluation is necessary for this shopper segment, considering the impact on profit margin. Check if the same product purchased by other shoppers has also been returned and examine the reason for returns. Let’s imagine a scenario where a specific product was purchased by 50 shoppers in the same timeframe, all fulfilled by the same fulfillment center and a specific delivery partner. If over 50% of these customers returned the items because of wrong delivery or product damage, then the issue could be a potential serial oversight that the retailer must address. This must be flagged right away to enhance the operational quality of the fulfillment center and delivery partner to prevent future returns.

Investigate product categories—electronics, clothing, and fashion accessories—with highest return rates from this shopper segment and implement a unique pricing and promotional strategy for them such as a special discount on their next purchase as a reward for choosing not to return. Additionally, find an efficient and cost-effective method to deliver this order; if there is an opportunity to deliver this order from a nearby local store, this option should be considered to minimize delivery costs. Moreover, provide alternatives such as a replacement order that includes free returns or an appropriate return fee to lessen the impact on profit margins. Also, implementing a distinct returns mechanism such as accepting returns only at stores based on the product value can act as deterrents.

Businesses implementing AI-driven budget optimization have achieved a 1.3X increase in return on ad spend (ROAS), as AI dynamically shifts investments based on live campaign data. AI-powered budget management has also resulted in a 12% reduction in wasted ad-spend, ensuring that resources are allocated efficiently to maximize campaign effectiveness.

While AI enhances incrementality measurement, helping brands distinguish between organic and paid conversions, enabling smarter investment decisions, predictive audience modeling allows AI to identify and target high-intent consumers, refining budget allocation for better ad performance.

The need for a data-driven strategy

There is no magic wand that can make returns vanish altogether.

Typically, returned goods often end up as part of discounted lines, jobber sales, or clearance outlets, undermining the potential to be sold at full price. Retailers must develop a data-driven strategy to dynamically determine the next best sales channel. The extent of the impact of returns on margin miles will depend on the industry, product, and the choice of delivery channel for both order fulfillment (forward journey) and the returns process. However, with the right fulfillment and return strategy, and personalized shopping and return experiences powered by data and AI, retailers can help mitigate the impact on profit margins, reduce return touch points, decrease packaging and shipping efforts, and minimize damage to the ecosystem.