Industry

HIGHLIGHTS

- The jewelry industry’s evolving demand and customer expectations call for a shift from intuition-based inventory management to structured, hybrid replenishment strategies.

- Combining inventory segmentation, AI-driven forecasting, and retail expertise will help optimize stock level & align supply with demand.

- This new approach can help the industry boost inventory turnover, ultimately enhancing ROI.

On this page

Abstract

The jewelry industry has seen a significant surge in demand over recent decades backed by changing lifestyles, investment practices, and increased spending power among younger cohorts.

With an annual growth rate of around 4.5% for the period 2024-2029 and global market size worth USD 0.48 trillion by 2025, the trend is expected to continue.

To capitalize on this growth jewelry retailers must balance sufficient inventory with a wide variety of choices to meet evolving customer expectations, making inventory management a key driver for the industry. However, fluctuating demand, competition, and high capital investment requirements pose significant challenges to inventory management in the segment. Traditionally, jewelry retailers have relied on the intuition of store executives to gauge inventory needs—a method that, while useful in simpler markets, is quickly becoming outdated. Customers now expect variety, personalization, and immediate availability, and traditional inventory practices are inadequate to meet these needs. Consequently, retailers face stockouts, excess inventory, and reduced inventory turnover, impacting their return on investment (ROI). Growth in this sector requires a more refined approach to inventory replenishment, leveraging inventory segmentation and advanced forecasting that can mitigate these challenges and help retailers thrive in a competitive landscape.

Complexity of inventory management in jewelry retail: A quick look

Due to its dynamic nature the jewelry industry faces various complexities in assortment planning and inventory management.

This paper outlines a segmented approach to address these. Here’s a quick look at key product types:

- High Runners: These high-selling items require frequent replenishment and accurate demand forecasting.

- Seasonal Items: Demand fluctuates based on occasions like weddings and festivals, needing anticipation to prevent stockouts.

- Low Runners: Items with low sales volumes requiring cautious inventory management to avoid excess stock.

- Specialty Items: These are unique or limited-edition pieces/collections with unpredictable demand. It requires a more cautious approach to balance availability as these items are necessary for maintaining a certain brand presence and differentiation. However, retailers need to simultaneously steer clear of potential overstocking. Most retailers depend on store executives to plan optimal stock based on their experiences and historical sales rather than real-time insights, limiting retailers’ ability to meet dynamic customer demands. We believe, a regular replenishment schedule is essential to sustain the industry.

Piecing a new approach

In a bid to understand and respond to the complexities of the jewelry industry, we engaged extensively with stakeholders and conducted on-ground assessments.

This involved interviews with 40 stakeholders and 18 visits to supply chain hubs, factories, and retail stores pan India and in Dubai. These efforts provided critical insights into the business context, operational intricacies, and industry-specific challenges. Our findings, recorded in business requirement documents, captured over 600 unique requirements.

Through data analysis and benchmarking against industry standards, we identified trends, bottlenecks, and opportunities for improvement. These insights were distilled into 14 improvement themes, addressing the core challenges while aligning with industry best practices. To enable these improvement themes, we formulated a supply chain target operating model spanning people, processes, and technology. The approach explains the new processes and the modification required in the current processes.

A hybrid inventory replenishment strategy

Large jewelry and luxury retailers across the globe have started adopting tools for efficient demand forecasting.

For instance, a large Hong Kong based jewelry retailer, and a European jewelry retail chain are implementing AI/ML driven forecasting tools to ensure accurate predictions. This approach is also offering their planners the much-needed analytical insights as they are now enabled to observe and incorporate the effect of multiple demand drivers into their forecasting models.

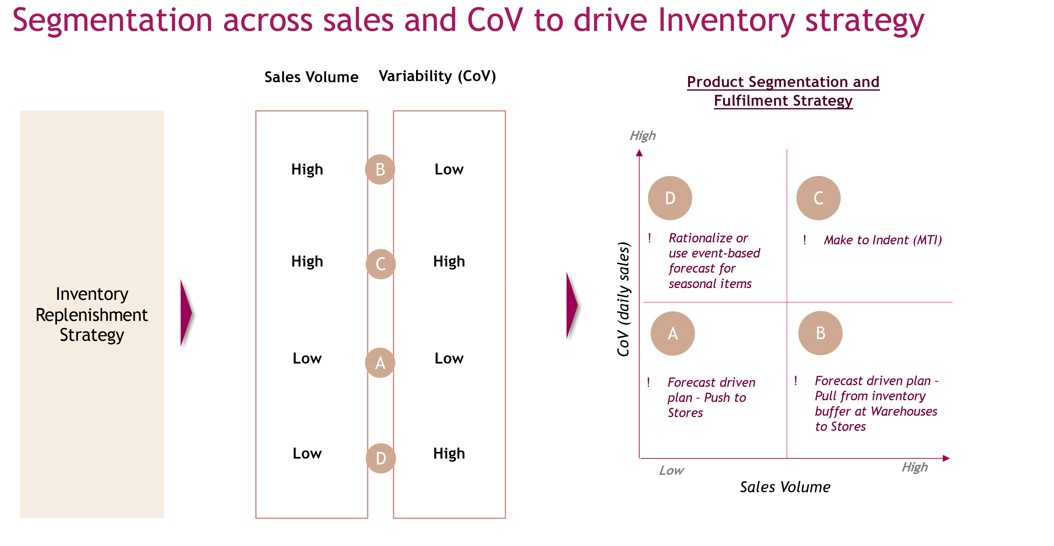

A hybrid inventory replenishment strategy involving a structured inventory segmentation framework can potentially help resolve some of the challenges faced by the retailers. This approach divides the entire assortment into 4 major segments based on the sales volume and demand variability as illustrated in Exhibit 1. This approach is based on extensive research by the authors and a careful examination of the inventory management practices across retail industry.

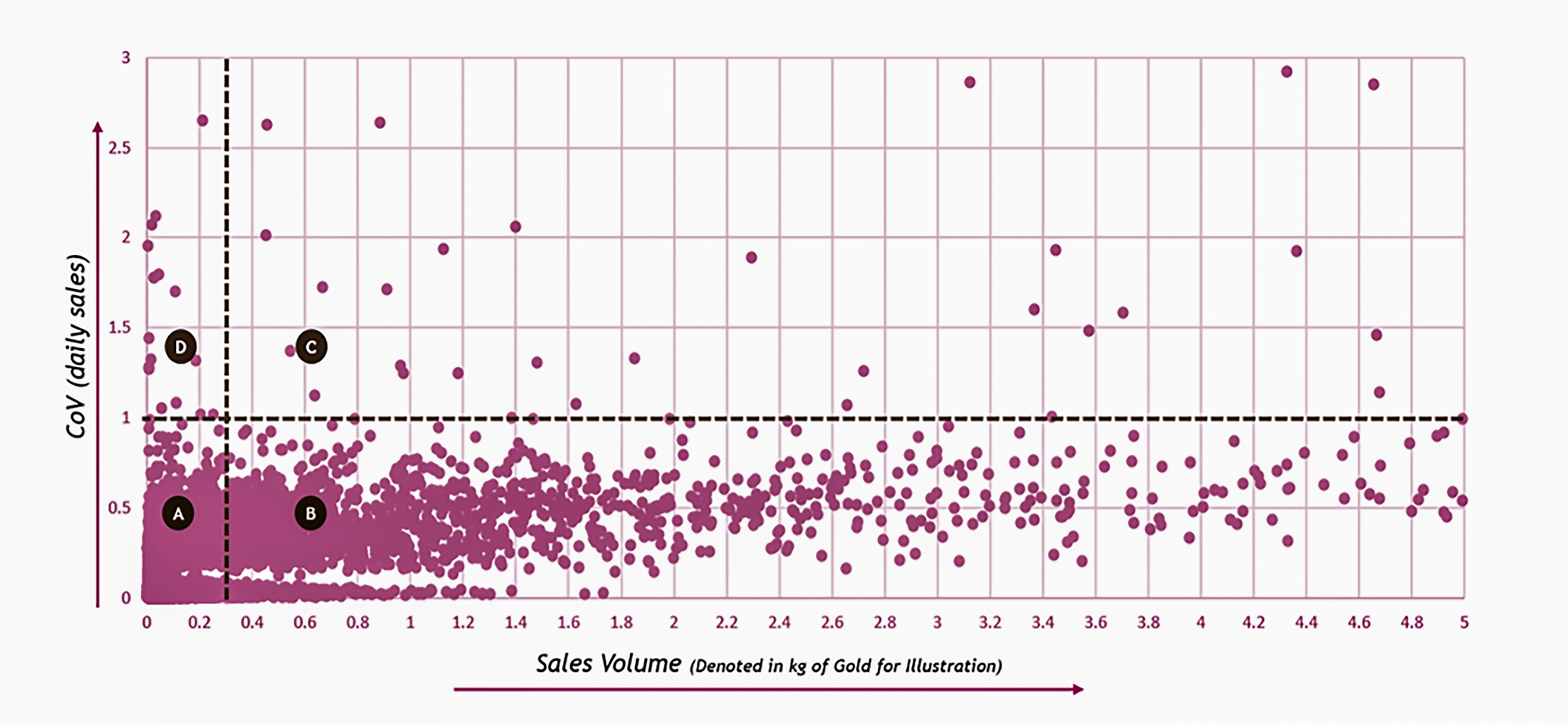

The scatter graph (Exhibit 1) effectively illustrates inventory segmentation. Assuming a stable demand scenario in the horizontal line it cuts the categories into 2 sections with dots concentrated both above and below the line. To plot the vertical dotted line, we performed an 80-20 analysis and drew the line such that the categories that contribute to 80 percent of the sales fall to the right of the line. This gives us a view of 4 segments of inventory. Segment A and B show the categories with low demand variation, i.e., stable or consistent demand. High demand variation is represented in areas marked D and C above the line. In a nutshell, the categories with low demand variation are easy to predict using the widely accepted methods like statistical forecasting.

Given the one-size-fits-all solution does not work for replenishment in the jewelry business, we recommend a hybrid approach - a combination of push & pull inventory replenishment for these 4 diverse segments. The combination of push and pull strategies allows jewelry retailers to align their inventory management with the specific needs of each product segment. This strategy offers the number of pieces that need to be maintained in store for a particular category, and not at a variant/SKU level. The SKU level decisions are made by the retail team so that they can maintain variety within a particular category.

A unique approach would be to use tool-based demand forecasting for the segments with low demand variation and using sales planning via retail executives for segments with highly volatile demand.

Here’s how this hybrid strategy will work:

| Quadrant | Sales Volume | Variability | Description |

| A |

Low |

Low |

Since these categories have a low CoV and stable demand, these categories should be forecast based on historical data and proactively replenished to maintain stock levels in stores. |

| B | High |

Low |

These categories have a stable demand but are higher in value – they can be forecast and stored as a regional inventory buffer for the associated stores. Based on the demand signals individual stores can replenish them from the regional buffer with a very short lead time. |

| C | High |

High | These categories are highly unpredictable - the sales plan should be jointly created by the store heads/executives in consensus with the merchandising and marketing teams, based on their experience. This can be for specific customer demand such as make to order or make to indent. If there’s a possibility of including few fast mover variants within a category these can be forecast and stored at a regional buffer as needed. |

| D | Low | High | These categories are highly unpredictable and low sales contributors – we recommend rationalizing the non-movers and refreshing the assortment plan. Only the categories required for brand presence or specific important collections should be retained. Some of the selected items can be added to a virtual design bank and any customers who wish to order an item can place a custom or made to order on demand. |

Exhibit 3: Hybrid Approach for Inventory Replenishment

Note: For items with minimum order quantity, irrespective of their inventory segments, these items should be stocked as reserved buffer stock at the warehouses and then replenished to the stores based on customer demand.

This rationalization of items not only helps create an effective assortment range but also avoid aged inventory caused by overstocking of non-selling items.

Apart from this, the seasonal inventory remains an exception in the jewelry industry as the time periods for seasons are smaller compared with other industries. To manage these seasonal spikes, the historical seasonal demand patterns need to be analyzed separately by excluding seasonal sales while conducting inventory segmentation for non-seasonal time periods.

The road ahead

The unique hybrid inventory replenishment strategy can help support continuous business growth.

However, the process of adopting new practices and technologies needs to be enabled through an appropriate and customized operating model suited to the organization and its culture.

Adopting these best practices and leveraging advanced technologies can help retailers significantly improve their inventory replenishment processes via significant ROI benefits backed by higher inventory turnover, crucial for sustainable business growth. This in turn can also help enhance customer satisfaction by achieving better store availability, freshness, and increased assortment.