Industry

Highlights

- RPA can improve accuracy and agility in manufacturing operations, especially its finance and compliance departments by saving time and manual efforts

- Focusing on F&A and compliance leads to faster business operations, minimal business impact, and reduced operational costs

- The RPA market is anticipated to grow at a compounded annual growth rate or CAGR of above 20% between 2019-2025

- Spending on RPA is doubling every year in India; IDC research shows that over 80% of medium sized and large businesses have put digital transformation as a strategic goal

In this article

Understanding RPA

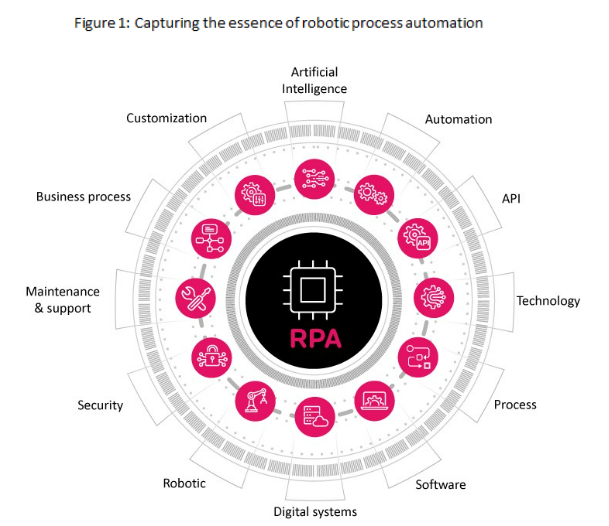

Robotic Process Automation or RPA is a software robot or bot that automates human interactions involving keyboard actions and mouse clicks, including fetching, and entering data from various digital systems, navigating systems, and operating systems. Bots can help manufacturing companies achieve productivity gains, to perform routine, rules-based service processes. These can be used even by non-technical employees to configure and solve automation challenges.

In the manufacturing sector, not only can back-office operations such as finance be automated but robotics can also be used in supply chain. Customer service, complaints, and employee hiring can also be automated [1]. Other repeatable tasks such as transferring data from multiple input sources such as email/spreadsheets to ERP can be automated too. Rule-based tasks used to carry out various business processes can be automated, although unattended processes (without human intervention) are more frequently automated [2].

A growing space

In India, spending on RPA is doubling every year. The RPA market is anticipated to grow at a compounded annual growth rate or CAGR of above 20% between 2019-2025. Most organizations are witnessing an increase in the adoption of automation in real time along with new use-cases being developed daily. For example, a manufacturing company in the edible oils business has implemented RPA for their contract and sales order management process while another one is implementing RPA to automate the salary processing of its employees. In yet another case, a company has automated the process to seek input tax credit on air travel for its employees [3].

Benefits galore

Clearly, manufacturing companies have discovered the benefits and are increasingly turning to RPA for agility and cost savings across the value chain. IDC research shows that over 80% of medium sized and large businesses [4] have put digital transformation as a strategic goal, and adoption rates of robotic process automation is forecast to grow by 57% in India in 2023.5 Enterprises are deploying RPA solutions with minimal business impact to improve accuracy, speed-up business operations, and reduce operational costs. RPA is also core to the Business 4.0 transformations, which facilitate automation and accelerate digital transformation and growth.

Key use cases in manufacturing (F&A)

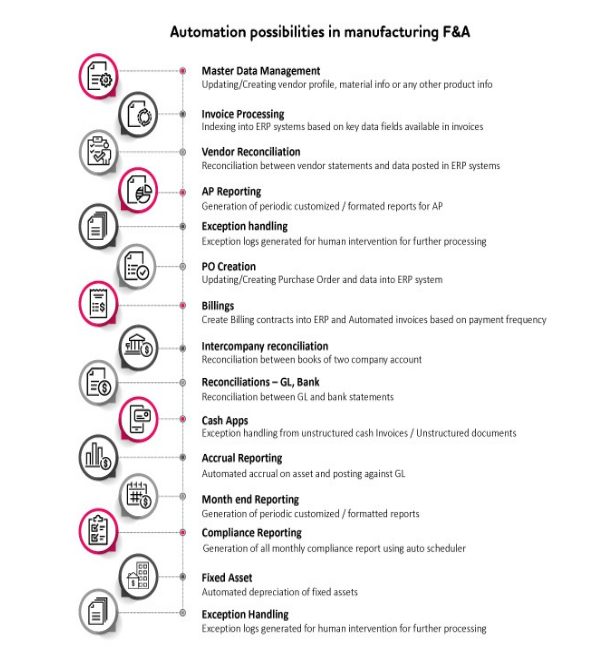

Some of the use cases in manufacturing where repetitive tasks that can be automated by configuring software robots are listed below. Improved compliance and efficiency, reduced cost, and process optimization are some of the benefits.

Compliance

There are many existing applications integral to the processes that use old technology and may not have application programming interfaces (APIs) to connect. There is a need to integrate such systems with APIs. Some of the newer applications can be portal based and on the web. The entire workflow and process thus improves through such integration.

There are numerous technologies that record mouse clicks and play back a user’s sessions, including the actions in a request response architecture. In automation testing, setting up test preconditions, and other test controls and reporting functions are automated. Going a step further, in a business process, it is now possible to pass parameters by predefining various inputs and outputs. Such seamless integration is now possible and leverages real time values. This helps test actions and improves the process. For example, instead of manually keying in configuration data for an automotive assembly line, for every new model, variable data can be self-adjusted for new models, improving turnaround time.

Automation can also happen in unattended mode where the bot can logon to the virtual machine (VM), perform the task and log off when the task is finished.

Consider a scenario where a legacy web app is being automated with a new list. The bot inserts the customer detail in an automated manner, and once the steps are recorded in the interface, commands are executed. For example, a large manufacturing company has different regulatory environments in different countries. It plans to use cloud services to digitalize data processing with intelligence that recognizes metadata in forms. RPA can seamlessly recognize forms that were on legacy systems in some countries in operation and integrate them. Low code business process automation enables an organization to improve its operations, thus providing business benefit.

Computation of gross liability: This is one of the processes under the indirect taxation department (IDT) that can be automated using RPA. For instance, for a large steel manufacturer any kind of sale of products involves GST charges, which are accounted for using the GST general ledger. Income-related transactions are accounted by income general ledgers. The process reconciles income GL and GST GL, which is primarily important for compliance requirement.

Through the reconciliation process, the IDT can clarify if the amount of income or GST booked is correct or not. If the GST is high, the steel manufacturer should get a credit note, which is a monetary gain for the company. If the GST is low, the manufacturer must immediately check and pay the balance amount to the government, otherwise it will be liable to pay a penalty.

The reconciliation process is done using an ERP suite. The data source and computing data obtained from specific ERP screens are ported onto an excel sheet, which are then calculated.

Availing Input Tax Credit (ITC) on air travel: According to GST norms, a company can claim ITC on air travel of its employees for business purposes. A manufacturer that books air tickets for many of its employees needs to raise a GST invoice for each ticket. The process involves collecting airline invoices received in e-mail and /or downloaded from the website against the agent file. Then, the GST invoice needs to be updated in the ERP system.

In automating the process, the travel request data is collected from mail/website sources and then matched with existing ERP data and after processing it through various levels, the invoice data is updated in the ERP.

Other functions that can greatly benefit from deploying RPA are:

- General ledger reconciliation process

- Invoice processing

In both cases bots can replicate manual functions using the ERP system such as extract reports, perform checks and validations, comparisons etc., thereby optimizing the operation, which provides business benefits in terms of faster execution and enhanced accuracy.

Automation of profitability reporting through RPA

Manual classification of products to be manufactured against requisite plants can also be automated. Once the manufacturing plant has assigned all products in the dump, sheets are prepared and sent to relevant stakeholders. The bot logs into ERP interface and downloads the different reports, collates and de-duplicates all the information in one place. The reports can then be sent to relevant business users to complete the process efficiently. The processing time is reduced significantly from over 15 hours to less than an hour as earlier the classification was done manually. Additionally, there is no human involvement, the impact on business is minimized with reduced instances of human errors and omissions, thus providing quality assurance.

Analysis

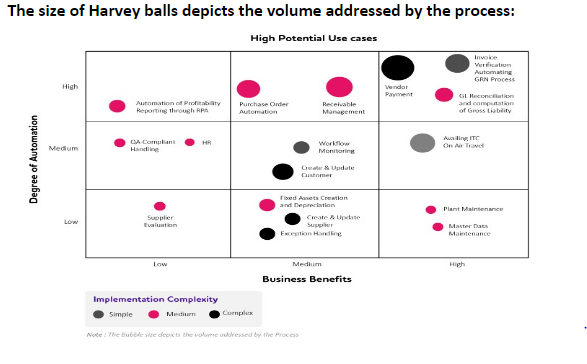

Based on the above use cases and automation possibilities, the automation potential and business benefits of RPA have been shown in the figure below. The size of Harvey balls depicts the volume addressed by the process:

Analysis for implementation complexity and business benefit

The following are the possibilities for automation in the finance and accounting function of the manufacturing sector:

Let us see an examples of what tangible business benefits deploying RPA, especially in F&A, can deliver for your enterprise.

a) A global diversified industrial company deployed RPA for time reduction in invoice processing, the benefits were 50% reduction in average handling time, increase in quality to 97% accuracy and a 50% increase in FTE or full-time equivalent savings that compares the time it takes to do a work manually with the output time of a bot doing the same work.

b) An industrial client deployed RPA for reduction in invoice processing time. It was receiving unreadable invoices for processing and different fields needed to be extracted that was done manually. The business benefit derived by deploying RPA was reduction in AHT, first time right processing and increase in quality. Typical benefits in procure to pay, order to cash, record to report can be 100% accuracy, 70% reduction in TAT, 100% compliance, efficiency increased by 60 to 70%, and more importantly improved user satisfaction.

Conclusion

Global manufacturers are trying to reduce operational expenditure, invest in process improvement, utilize existing capacity optimally, and increase efficiencies, while maintaining product quality and meeting safety and regulatory norms. The answer to all this is a high degree of automation which has transformational business benefits that can contribute to the exponential growth of a business. For instance, in most cases where RPA was adopted for F&A, the day’s sales outstanding improved by 60% and bad debts reduced by 70%. In the case of general ledger, closing timelines improved by 80%, and accuracy of entries by 90%. Overall, errors, delays, and inefficiencies caused by manual processes were removed, thus improving compliance and efficiency. We can also conclude that delivery to the ecosystem becomes efficient, reducing cost and creating new business channels. Processes are thus optimized, and a perspective emerges on where to innovate for your business.

References

- Toward the Bot Economy: Taking Robotic Process Automation to the next level

- The Forrester Wave™: Robotic Process Automation, Q4 2019

- RPA helping governments and enterprises

- Automation enables Indian organizations to wade through logistics issues exposed by covid19

- IDC Research