Services

Highlights

- Delays in IT separation in a divestiture can result in financial penalties, regulatory glare for non-compliance, and loss of transaction value. Legacy systems, often maintained for long product lifecycles and regulatory reasons, complicate data migration and integration, demanding ongoing support and rigorous validation.

- Modernisation accelerates separation and cuts costs, with cloud migration and SaaS reducing timelines and operational expenses significantly.

- In life sciences and healthcare M&A, IT separation is a test of strategic precision and not just a technical carve-out. Leading LSHC organisations seize the moment to re-platform, to drive agility and modernisation while balancing scientific rigour, compliance, and shareholder value.

Challenges

Life sciences and healthcare (LSHC) organisations face distinct challenges in IT separation during divestitures or carve-outs. Stringent regulatory requirements, highly integrated legacy systems, and the sensitive nature of data make divestitures in this sector complex. Extended transition service agreements (TSAs) are, therefore, common, as deeply embedded validated applications and shared infrastructure require careful decoupling. Delays in IT separation can result in financial penalties, regulatory non-compliance, and loss of transaction value. Legacy systems, often maintained for long product lifecycles and regulatory reasons, complicate data migration and integration, demanding ongoing support and rigorous validation. Ensuring data segregation is critical to meeting standards of Health Insurance Portability and Accountability Act (HIPAA), General Data Protection Regulation (GDPR), and other global privacy mandates; lapses can trigger regulatory scrutiny or disrupt business operations.

A major post-day 1 challenge in manufacturing site separation is limited trust with SpinCo, the new, independent company created when a parent firm spins off part of its business. This is—especially true for legacy applications compliant with good manufacturing practices (GMP) but lacking documentation and connected devices. Good practice (GxP) validation for configuration changes can lead to downtime and impact production. Grouping related applications by department enables a phased separation, reducing disruptions. Quality management system (QMS) data gaps, including incomplete audit trails or missing validation records, threaten approvals and product launches. The interconnected nature of clinical, manufacturing, and commercial activities means that errors in IT separation can have far-reaching consequences, impacting patient safety, supply chain integrity, and compliance.

Guiding principles

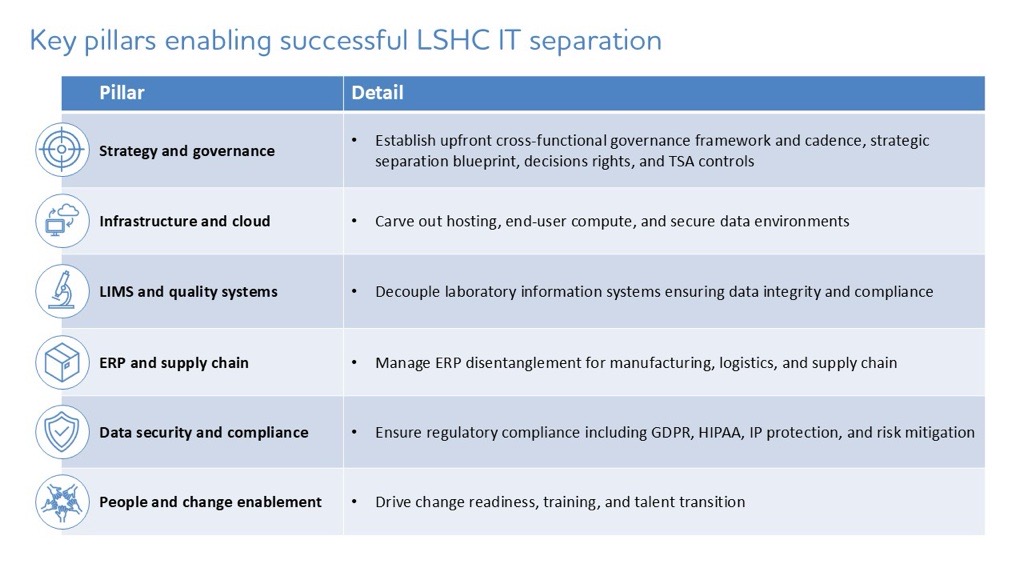

Effective separations in the LSHC sector hinge on early, cross-functional collaboration and disciplined governance (see Figure 1). Involving the information technology (IT), business, and legal teams from the outset, beginning with divestiture planning through to execution, ensures unified oversight and transparent communication. Regulatory compliance is non-negotiable. Embedding GDPR, HIPAA, and GxP checks into every separation milestone prevents compliance lapses, supports audit readiness, and safeguards the integrity of sensitive data throughout the process.

Modernisation during divestiture accelerates separation and cuts costs. Our experience suggests that cloud migration and SaaS reduce timelines by about 30% and operational expenses by roughly 25%. Proactive risk management, thorough master data checks, and compliant legacy system decommissioning lessen operational and compliance risks, safeguarding business continuity throughout the transition. By applying these practices, organisations maintain transaction value, meet regulatory requirements, and achieve a smooth IT carve-out that supports long-term goals. Industry merger and acquisition (M&A) examples, such as a large pharma company’s mirrored ERP environment and a global medtech firm’s migration of over 1,400 applications, underscore the need for robust planning, data segregation, and thorough separation inventories.

Focus areas

There are six critical areas that determine the success of IT separation.

These are:

- GxP-regulated environments: Quality, regulatory, pharmacovigilance, and manufacturing processes ensure compliance and product continuity. Disruptions can halt batch release, trigger deviation reports, or risk market authorisation. Marketing authorisation transfer (MAT) must be integrated into this domain, not treated as a post-close legal task. The MA holder owns labelling, safety, and product release, so any system change affecting these workflows must maintain validation and traceable data. IT separation includes migrating regulatory data, sustaining electronic common technical document (eCTD) and pharmacovigilance (PV) systems, and re-establishing submission gateways without validation gaps. The MAT timeline drives TSA dependencies, requiring tight coordination among regulatory, quality, and IT teams to preserve licence-to-operate and ensure day-1 readiness.

- Product serialisation and global traceability: Serialisation connects product identity to worldwide regulatory reporting. During separation, Electronic Product Code Information Services (EPCIS) repositories, aggregation hierarchies, and reporting credentials must be precisely decoupled and reassigned. Even small mistakes in plant codes or serialisation masters can block shipments or create compliance risks. IT must revalidate interfaces with authorities (eg, Drug Supply Chain Security Act under the US Food and Drug Administration, and European Medicines Verification System under the European Commission) under GxP controls and maintain transaction data continuity. Serialisation supports MAT by demonstrating continuous control of serialised products for the new MA holder. Early testing and parallel reporting cycles are critical before legal closing.

- Clinical systems and patient data integrity: Clinical platforms, such as clinical trial management system (CTMS), electronic trial master file (eTMF), interactive voice/web response system (IVRS), and electronic data capture (EDC) , hold regulated data critical to trials and submissions. Disruptions to these systems threaten patient safety and filing accuracy. IT separation must involve validated migrations, preserving audit trails and investigator access, necessitating early TSA stand-up. Controlled revalidation, sustained role-based access, and document traceability maintain regulatory trust and asset value.

- Laboratory information management systems (LIMS): LIMS links manufacturing, quality, and research and development (R&D), managing validated specs and results causing separation complexity. IT must separate instruments, methods, and standards while maintaining GxP compliance and data integrity. After migration, revalidate systems, align codes, and ensure quality analysis (QA) oversight for testing and submissions. Preserving data integrity is vital for quality and regulatory operations.

- Master data consistency: Master data connects supply, finance, and quality. Misaligned codes or hierarchies can disrupt day-1 operations. IT should conduct controlled cutovers with validation and establish governance for reconciliation across ERP, QMS, and serialisation. Golden-source identification—consolidating and validating data from various sources to establish a single, trusted record for an entity—prevents margin loss or reporting errors.

- Legacy and custom system decommissioning: Legacy systems pose compliance and cost risks. Early identification and compliant archiving of regulated data, especially from validated or clinical systems, reduce audit exposure. A validated decommissioning plan accelerates TSA exit and secures access to historical regulatory evidence.

The path forward

In LSHC M&A, IT separation is not just a technical carve-out, it is a test of strategic precision. Leading LSHC organisations seize the moment to re-platform, to drive agility and modernisation while balancing scientific rigour, compliance, and shareholder value. Success means viewing separation not as a cost exercise but as a chance to build an agile, connected, and compliant digital core. To unlock strategic value, LSHC organisations must deploy a carveout factory model, establish a central separation management office, align business and IT early, and harness advanced technologies like artificial intelligence (AI)-powered data mapping and cloud-native tools.

Proactive risk management, LIMS validation, master data integrity, and compliant legacy system decommissioning protect margins and ensures audit readiness. With investors demanding resilient, turnkey assets, IT separation should ensure a competitive edge and should not be seen as a mere necessity. In an era of mounting regulatory pressure and evolving data rules, true leaders embed innovation into every separation, accelerating transformation, while building trust through disciplined execution. Those who combine digital precision, speed, and resilience throughout the transition will enjoy sustainable advantage.