Industry

Solution

Highlights

- Client experiences premised on hyper-personalization, trust, security, and speed have become the hallmark of today's wealth management and private banking industry.

- A leading global asset management firm, already a TCS BaNCS customer, sought TCS's help to enhance performance measurement and analytics for over one million digital advisory clients, representing five times the existing volume.

- TCS BaNCS solution fully met the performance requirements, processing ten times the volume of portfolio valuations in half the previous time while enabling sub-second API response times for high responsiveness.

On this page

Wealth modernization

Financial vulnerability triggered by the onset of the pandemic has increased investments, trade volumes, and market volatility worldwide. In response, wealth and investment players in the retail and institutional sector have quickly begun considering modernizing their technological landscape and platforms, even as they expand solutions covering the full spectrum of services to their clients.

Broader holistic advice catering to every type of asset and the need to provide client experiences premised on trust, security, and speed have become the hallmarks of the wealth management and private banking industry today.

The emphasis is on data-driven innovative services focused on hyper-personalization, managing data protection laws, and transparent pricing. Wealth and asset managers want to help their clients grow their investments spanning traditional and alternative assets as the relationship evolves.

Underpinning the drive for modernization are a range of transformative technologies:

- Cloud, especially with a SaaS-based approach, is needed for innovation, efficiency, and scale to manage unprecedented trade volumes.

- Digital-first approach to enhance UI/UX, zero-touch advisory services, low code, and no code tools for a blend of face-to-face and remote advice.

- AI to consolidate, study, and protect data, combat fraud, improve operational efficiency, and assess portfolio impact.

- Advanced analytical tools to scout for hidden opportunities, review past patterns, make relevant recommendations for trust-based advice, and increase advisor productivity.

The right proposition

TCS BaNCS for Wealth Management strengthens wealth managers' and clients' relationships, stimulating the much-needed reassurance and transparency clients need about their investments. TCS BaNCS' comprehensive suite of services, encompassing wealth and asset management and private banking, is tailored to facilitate informed decision-making, meet dynamic customer demands and regulatory expectations, and facilitate quicker processing times.

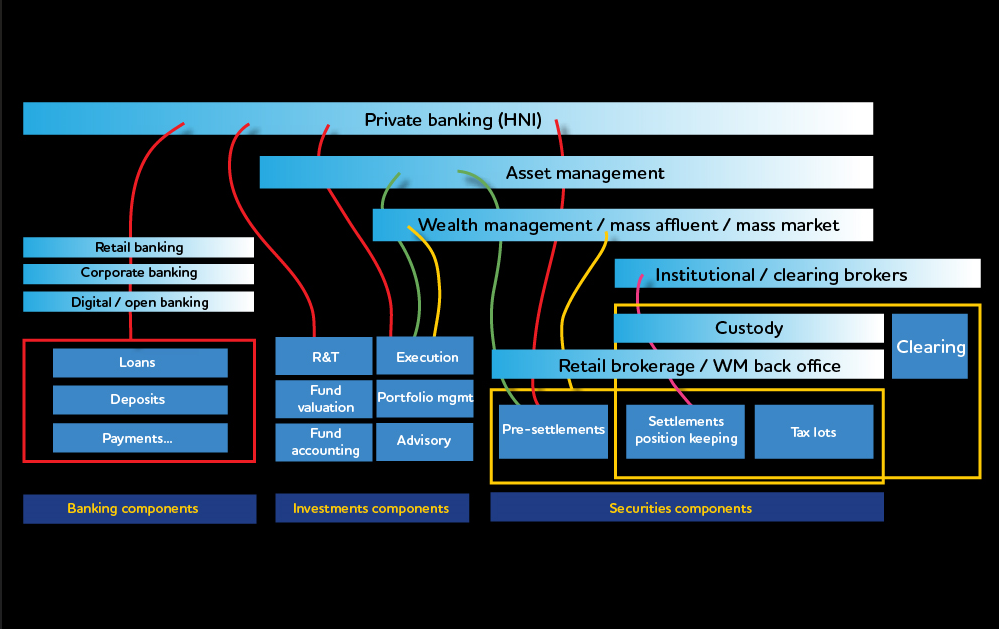

TCS BaNCS components across banking, investments, and securities are assembled to deliver a tailored proposition for each segment. These foundational components provide the breadth of capabilities across banking, and when packaged with the securities back-office functions of position management and settlements, they address the transaction processing needs of a typical retail broker or wealth management back office.

Extending these capabilities with solutions for advisory, portfolio management, and execution caters to the needs of a typical wealth provider for mass affluent segments. Adding fund accounting, valuation, and R&D capabilities broadens the proposition for asset managers. The clearing components extend the capability to institutional/clearing brokers. In short, the solution offers a tailored proposition for a typical private bank across the spectrum of its business.

Design to delivery

One of the world's leading asset management firms and an existing TCS BaNCS customer turned to TCS to deliver a highly scalable and reliable performance measurement and analytics engine. This engine supported more than one million clients of its digital advisory service, representing five times the existing volume. Those clients included ultra-high-net-worth individuals, for whom processing accuracy is paramount, and entry-level investors, for whom the low-latency response is vital for retention. This transformation program eventually enabled the firm's digital advisory business to foray into retirement portfolios.

As part of the engagement, TCS took ownership of the application support for the deployment of TCS BaNCS for Wealth Management, including responsibility for all business and technical operations related to security, monitoring, upgrades, integration, and backups.

To ensure processing accuracy in calculating portfolio performance, the application logic underwent meticulous review, including pre- and post-validation checks. This approach aimed to pre-empt any data pitfalls and provide highly accurate computed results to end clients.

To ensure high performance, the solution had to meet two benchmarks:

- Calculate daily positions in less than four hours (daily volume of more than 4MN accounts containing more than 20MN positions).

- Deliver all on-screen responses in less than two seconds.

The portfolio performance component of TCS BaNCS was deployed on AWS using a target microservices architecture. The decoupled architecture uses microservices to enable parallel processing for end-of-day position management and handle high volumes in smaller batches.

Key success metrics

As promised, the TCS BaNCS solution fully met the performance requirements. Benchmarked results demonstrated the ability to compute 10x volumes of portfolio valuations in half the time previously required while enabling sub-second API response times for high responsiveness. In addition, the cloud-related innovative methods enabled significant reductions in execution times, throughput, and database performance compared to prior operating models.

- Incoming load analyzer – Optimal infrastructure usage at 85%

- Polymorphic batch controller – 75% reduction in execution times

- Hyperthreaded architecture – 2x improvement in database performance

- Self-contained quality monitors – 80% increase in throughput

With TCS BaNCS, the asset management firm is now able to attract more customers to its innovative digital advisory service, confident that they will receive highly accurate portfolio information and benefit from an optimal user experience.